Community ideas

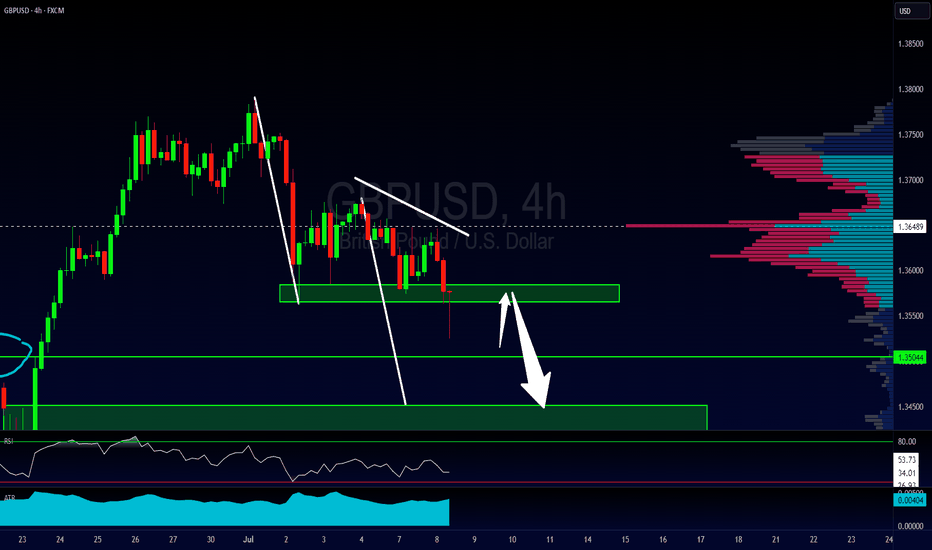

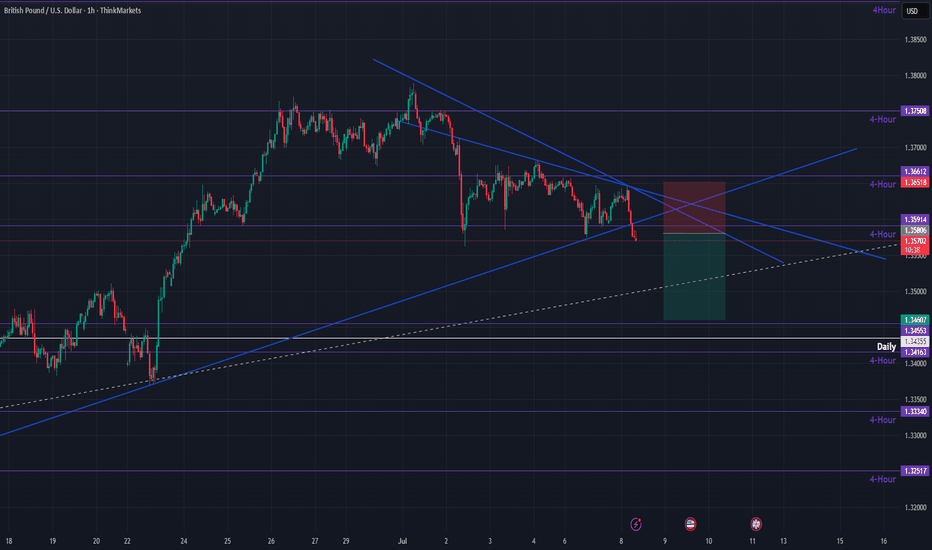

A Good Trade & An Even Better Trading LessonA good trading idea on the GBPUSD, looking at a potential bearish trend continuation trade using a breakout & pullback technique. But an even better trading lesson on the importance of having rules for how to analyze the market so that you can avoid confusion and/or conflicting signals.

If you have any questions or comments please leave them below.

Akil

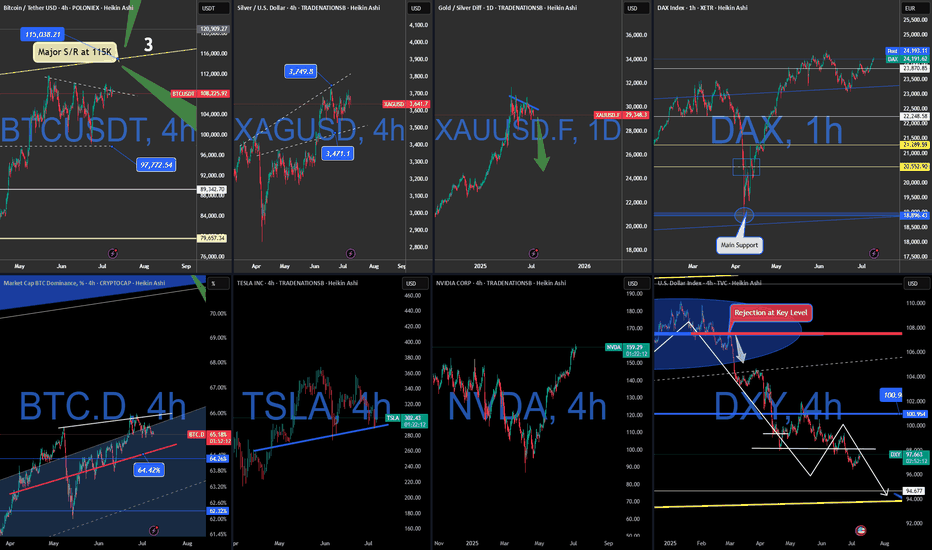

Macro Moves & Market Reversals: BTC-Metals-Tech-Dollar & more! 🤖📊 Macro Moves & Market Reversals: Bitcoin, Metals, Tech, Dollar & DAX Breakdown 🔥💹

Hey beautiful people,

FXPROFESSOR here with a massive market update to kick off the week. This one’s for my serious traders—those of you ready to read the market like a pro 📚💡

We’re in a critical transition. The Trump–Powell standoff, rate cut games, tariff escalations, and a surprising shift in risk appetite across bonds, metals, and equities are reshaping the entire trading landscape.

Let’s get into the full breakdown 👇

🧠 MACRO FIRST – THE FUNDAMENTAL PULSE

🟢 Interest Rates:

The Fed is keeping rates steady at 4.25%–4.50%, citing strong jobs data. 147K jobs added, unemployment at 4.1%. The market wanted bad news for rate cuts... didn’t get it.

🗓 September remains the most likely cut, but the Fed isn’t rushing. Strong labor = slow policy change.

⚠️ Tariffs Heating Up:

Trump just slapped 25–40% tariffs on imports from Japan, Korea, and others – effective August 1.

➡️ If no political resolution by July 9, prepare for a volatility wave.

Tariffs = supply chain risks + cost-push inflation.

💣 Geopolitics:

Middle East tensions remain background noise, but no major disruptions for now. Still, oil remains sensitive.

📈 Risk Appetite (Bonds):

U.S. Treasuries still lagging, but junk bonds and quality credit (LQD) have pumped. That’s a big clue: risk appetite is returning, even without a Fed pivot.

📉 DOLLAR INDEX (DXY) – "THE YEAR OF THE NORMALIZED DOLLAR"

We’ve followed this dollar short all year.

🔻 From rejection at 100.965, DXY dropped straight into our long-term 94–95 target zone.

📌 Now what? This level is MAJOR. A bounce could trap dollar bears.

🧭 No new short from me unless we re-tag 100+. The juice is squeezed.

Key takeaway:

The dollar already priced in rate cuts, and we didn’t even get them. That’s telling me the next macro move might not be so predictable.

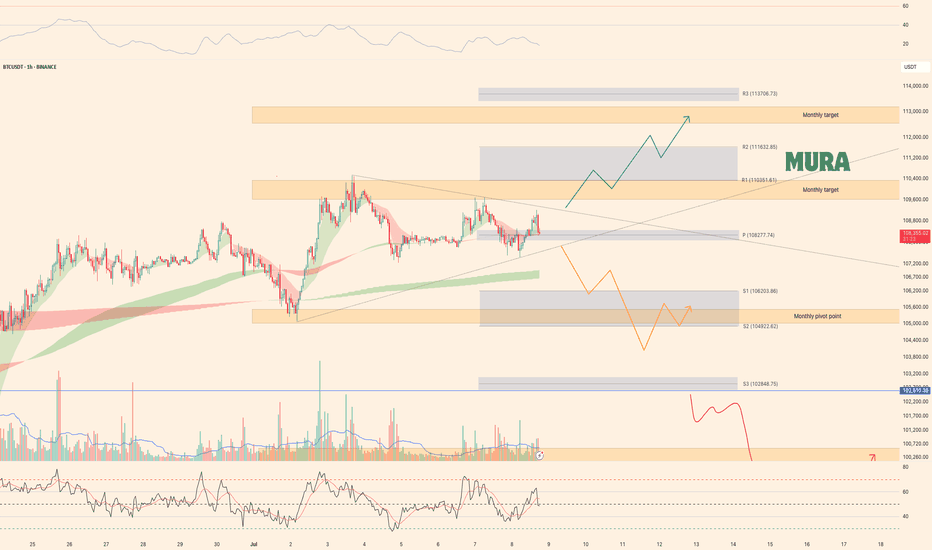

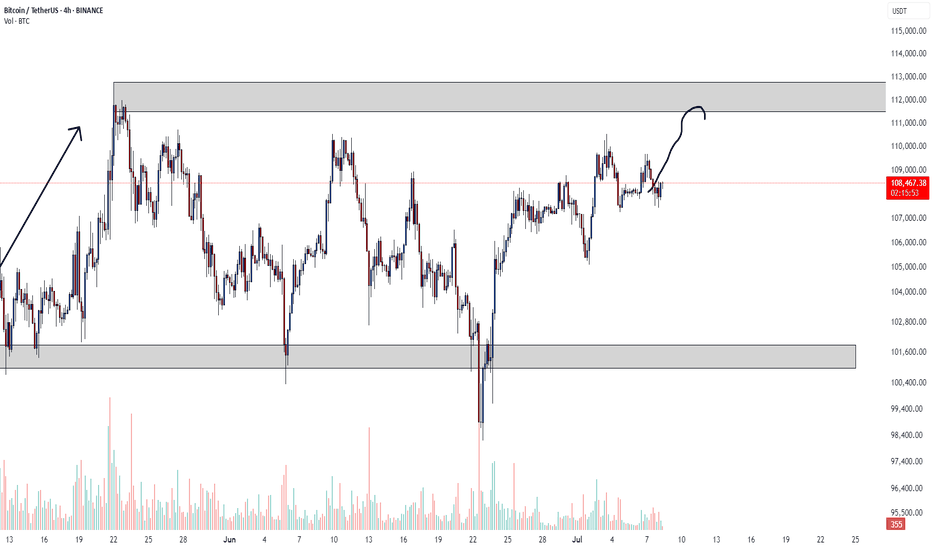

💰 BITCOIN – STILL THE KING

📍 BTC at $115K resistance – a level I’ve charted for years, not weeks.

Three hits:

1️⃣ First rejection

2️⃣ Second rejection

3️⃣ And now... a decisive moment

🚨 Break 115K → BTC flies.

📉 Fail here → we could revisit $64K, yes, seriously. I’m ready for both outcomes.

This is not the time for hopium. It’s 50/50.

🪙 BTC DOMINANCE – THE ALTCOIN SWITCH

BTC.D is now above 65%. That means:

✔️ Capital flowing back into BTC

❌ Altcoins not ready yet

We don’t chase alts until BTC.D hits 71.3–72.9%. That’s the real “altseason trigger zone.”

🔒 I’m personally turned off from alts for now—too much noise, too many memes, not enough macro support.

🔩 PRECIOUS METALS – SHINING BRIGHT

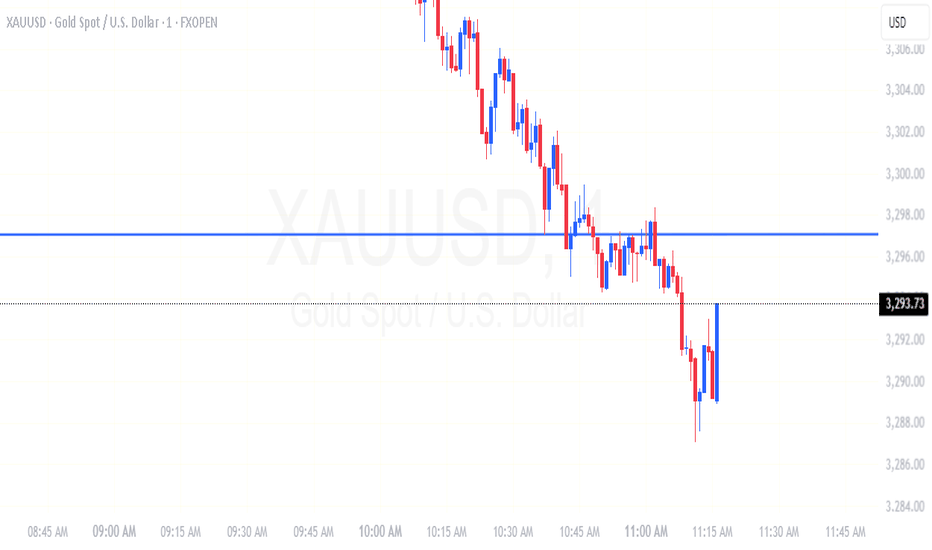

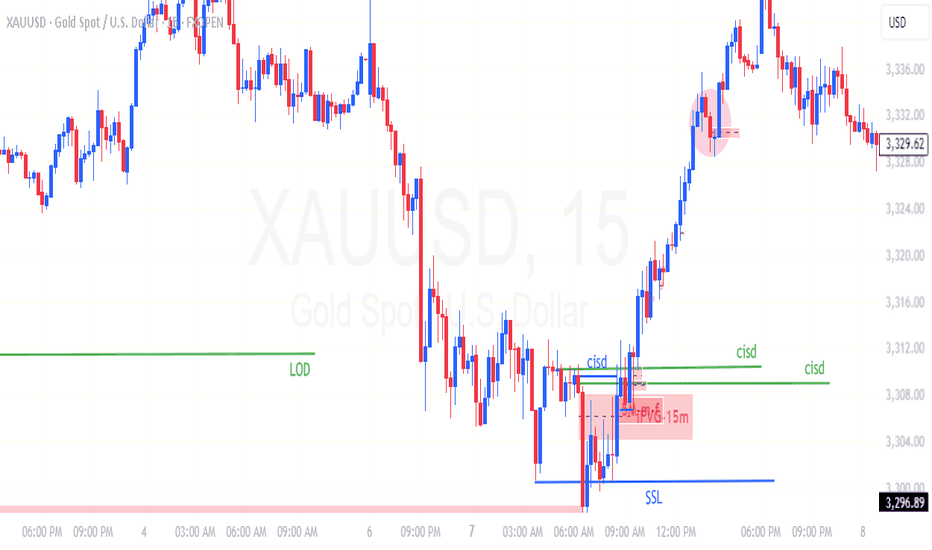

💛 Gold (XAU/USD):

Reached near $3,500 highs

Now stalling

🛑 Taking profits here – caution warranted.

🤍 Silver (XAG/USD):

13-year high

Holding $36+ well

Potential breakout pending global inflation data

💿 Platinum (the sleeper):

+47% YTD

Beautiful long setup played out exactly as planned

Still bullish above $1,400 if supply squeeze continues

💡 ETFs in metals are seeing inflows – more institutions hedging as dollar weakens.

🚗🔌 TECH STOCKS – NVDA, TSLA & THE NASDAQ

📈 NVIDIA (NVDA)

Best trade of the year for me

Clean re-entry, now hitting ATH levels

AI demand + tight supply = rocket fuel

⚡ Tesla (TSLA)

Bounce off 4H trendline

Still lagging slightly – political tensions (Trump vs. Musk) not helping

But levels are working like a charm

📊 NASDAQ (QQQ)

Hit our “max pain” zone perfectly

Rebounded with textbook precision

Momentum intact – watching for new highs

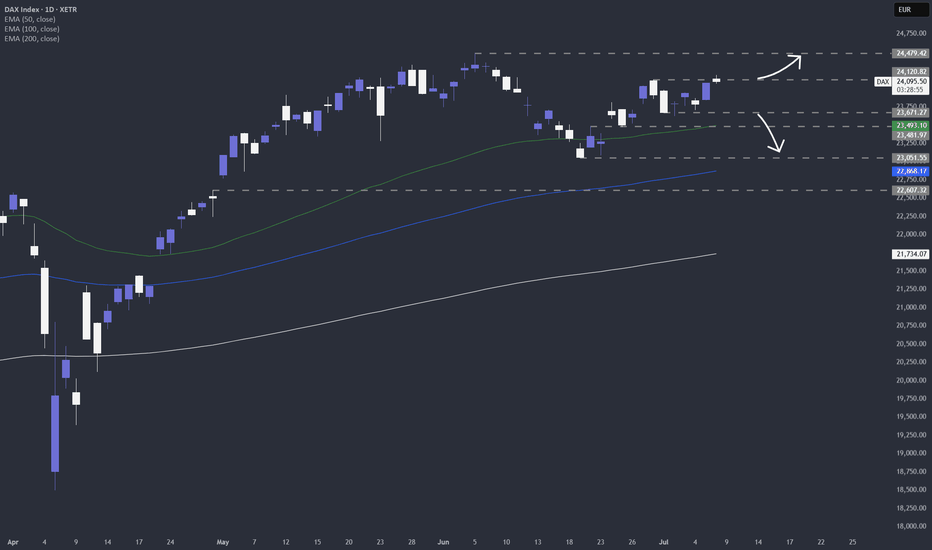

🇩🇪 DAX INDEX – CHARTS DON’T LIE

All-time high. Boom. Called it weeks ago.

Despite:

No Russian energy

Industrial drag

ECB policy constraints

📌 But what worked?

➡️ Simple chart structure.

➡️ Market psychology.

➡️ Pure TA.

Now at resistance again. Watch carefully – support below is clearly defined.

🧾 FINAL THOUGHTS – THE PROFESSOR'S NOTES

🔹 The market’s narrative can change fast, especially with Trump in the mix. He’s Mr. Volatility.

🔹 Powell holds the real power – and right now, he’s not flinching.

🔹 Risk appetite is back – but not evenly. Bitcoin is leading, altcoins are lagging, metals are maturing.

🔹 If rate cuts materialize in September, expect massive rotation across all risk assets.

💭 Until then, I’m playing level-to-level. No FOMO. Just charts and logic. That’s how we survive, and thrive.

Let me know which chart you want next – and thank you for staying sharp 💪📚

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

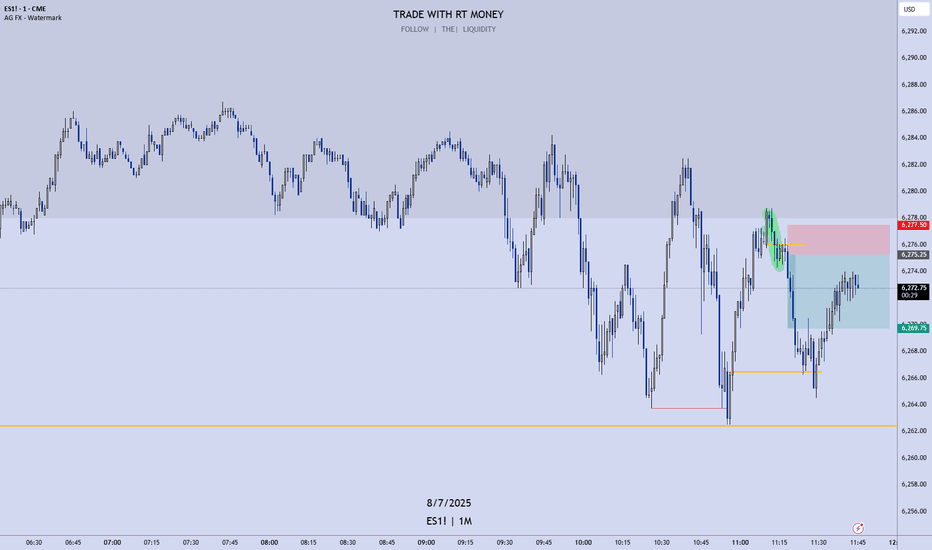

Watch me trade NQ LIVE!This is a just a quick video showing what I look for in order to take a trade.

I entered a short on NQ minutes ago, looking for 2.44 RR!

Apologies for this rough cut video. It was spur of the moment, and I wanted to share with my followers and viewers!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

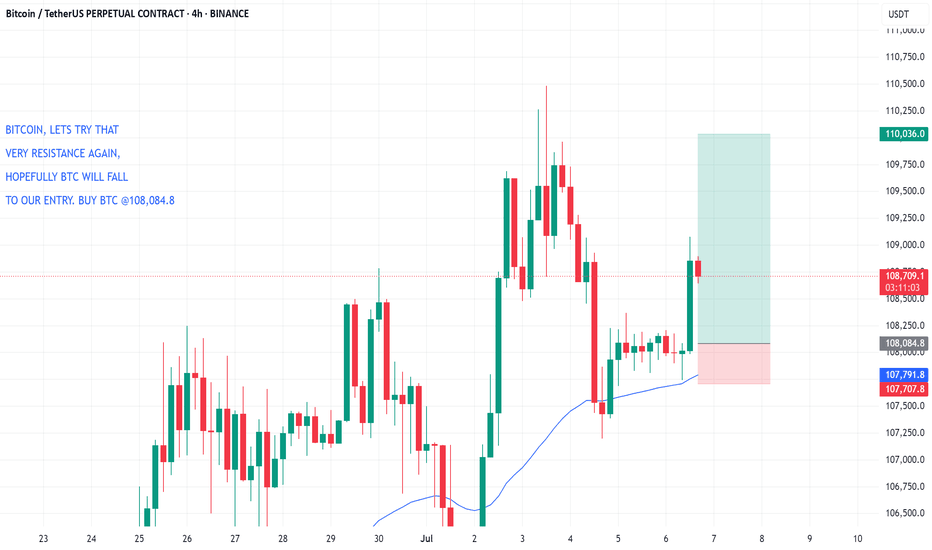

Trading plan for BitcoinLast week, price action followed our bullish (green) scenario perfectly. Currently, the chart shows a clearly defined narrowing triangle. A breakout of the trendline will confirm the next directional move. We still have potential for new ATHs, though a corrective pullback might come first. More details in the video itself - enjoy watching!

As always, manage your risk wisely.

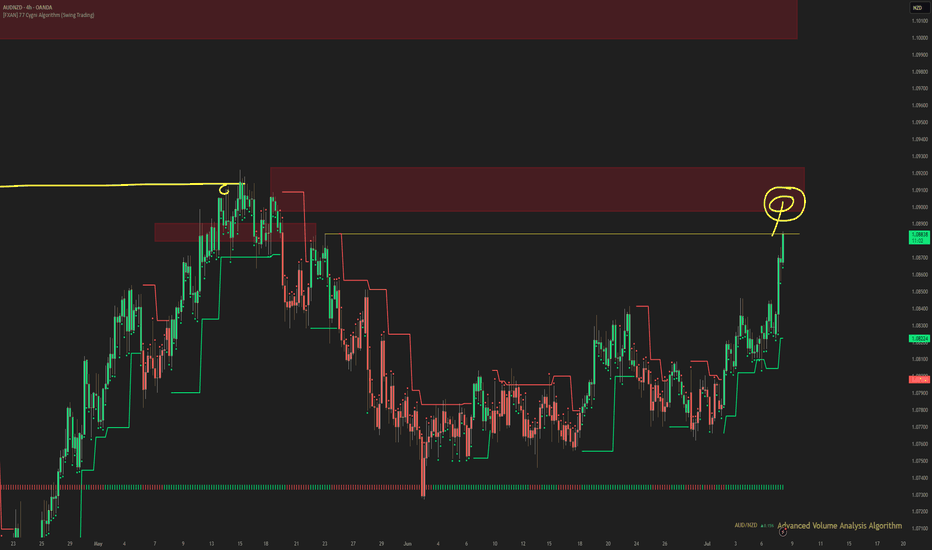

AUDNZD; Heikin Ashi Trade IdeaOANDA:AUDNZD

In this video, I’ll be sharing my analysis of AUDNZD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Quick take on DAXTariffs, no tariffs, tariffs, no tariffs... Let's look at the technical picture...

XETR:DAX

MARKETSCOM:GERMANY40

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

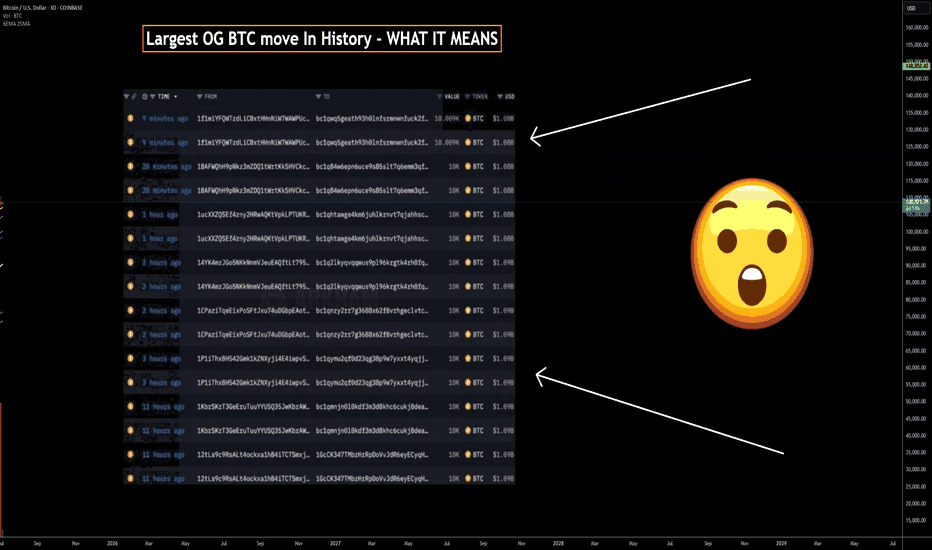

80k BTC On The Move - WHAT It Means 80,000 BTC Wallet Movement (2011 Miner)

• Source: 8 wallets containing 10,000 BTC each — mined in 2011, dormant for 14 years

• Total Value: Over $8.6 billion USD

• Timing: Moved on July 4, 2025 — largest dormant BTC transfer in history

• New Addresses: Funds moved to modern SegWit wallets

• Probable Owner: Likely a single early miner with 200k+ BTC history

Possible Reasons for the Move

• Key Rotation: Upgrading to modern wallets for better security

• Recovered Access: Private keys may have been recently recovered

• Market Strategy: Positioning for profit-taking or major sell-off

• Yield Farming: Preparing COINBASE:BTCUSD for use in DeFi/lending platforms

• Collateral Use: Possibly for loans, stablecoin leverage, or RWAs

• Estate Planning: Legal restructuring or generational wealth setup

• OTC Transfer: Could be prepping for off-exchange institutional sale

• Psychological Warfare: Could be intended to spook or manipulate the market

• Regulatory Response: Aligning with new compliance or tax jurisdiction

Market Reaction

• COINBASE:BTCUSD Price Dip: Price briefly fell below $108,000 post-move

• ETF Context: Movement occurred despite record ETF inflows

Key Note: These wallets had not been touched since COINBASE:BTCUSD was worth ~$0.78. Their reactivation adds uncertainty and opportunity in a fragile macro environment.

• What to do????: Watch the orderbook to find these large bitcoin moves in case of exchange selling

Near term support & resistance

$106000 support

$109500 first resistance

👍 If this breakdown helped your trading, smash that Like and drop a comment below—let me know what you think will happen with the 80k COINBASE:BTCUSD . 👍

Best Reguards

MartyBoots, 17-year market trader

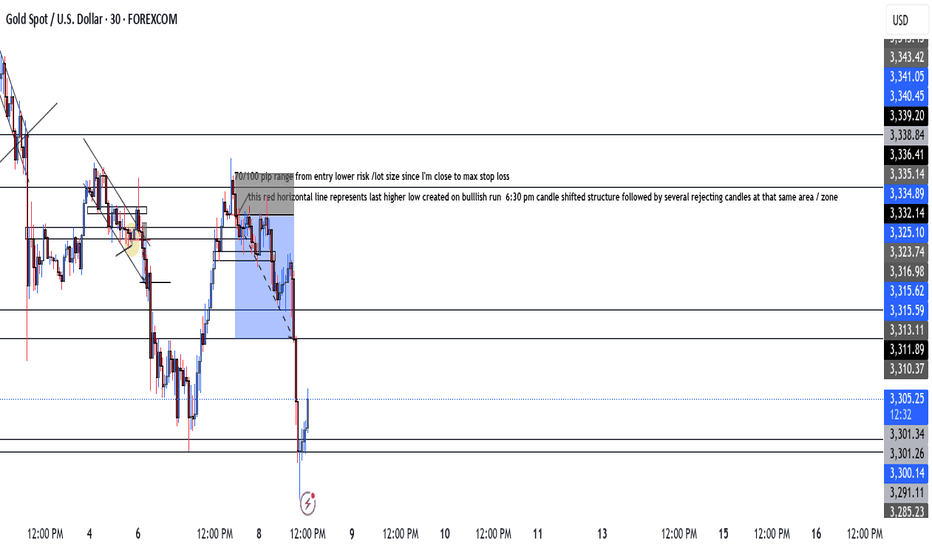

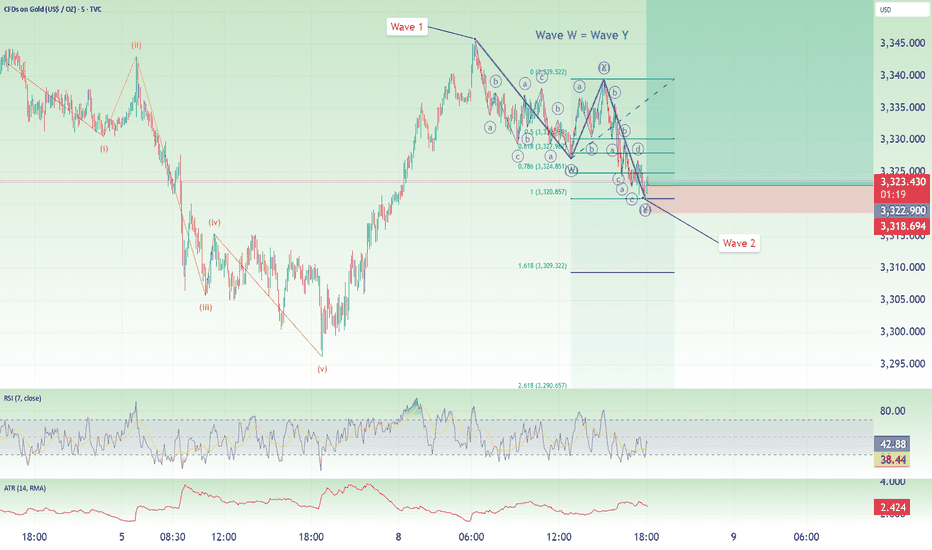

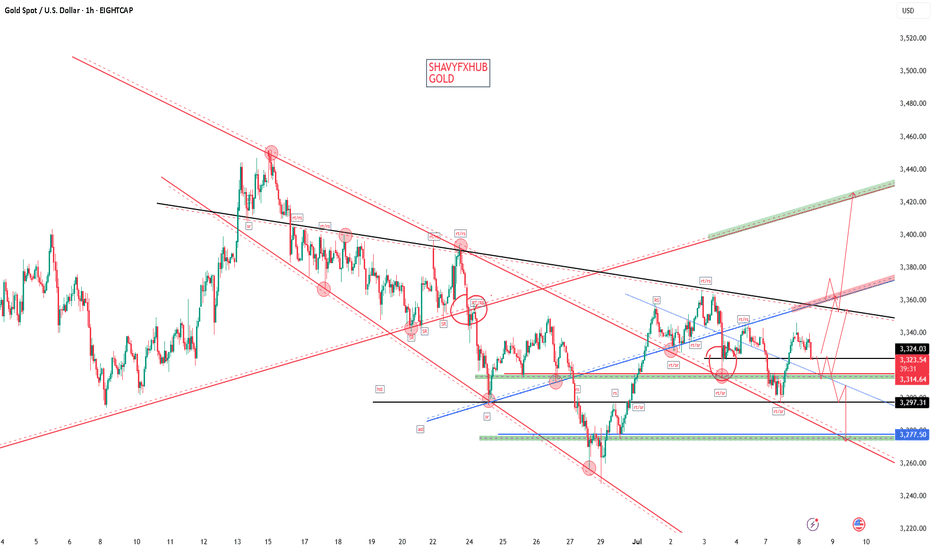

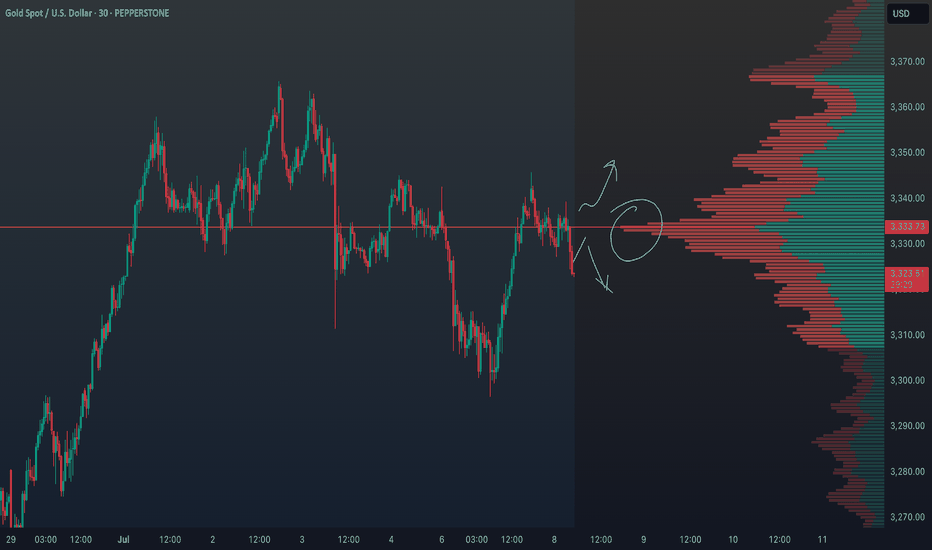

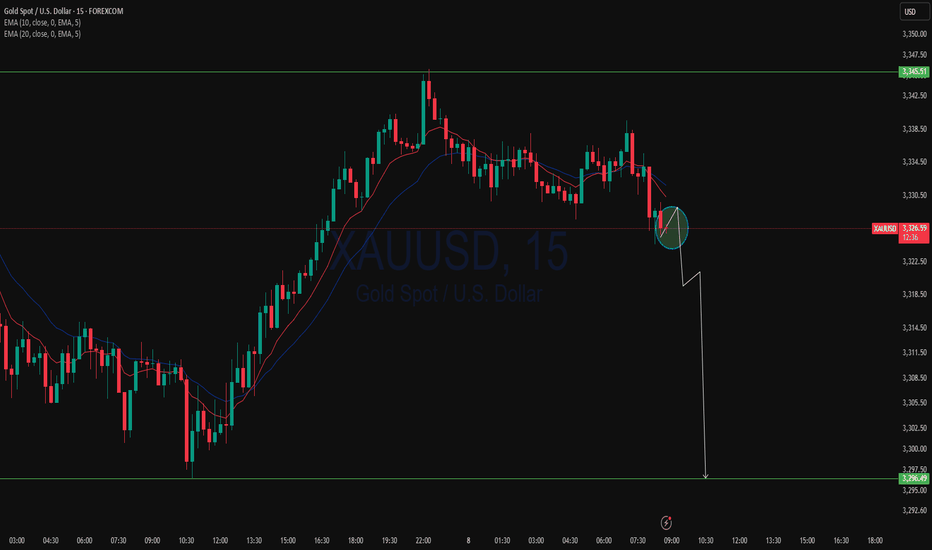

GOLD GOLD ,AM WATCHING 3314-3312 for buy ,the 1hr rejection will be watched , the US10Y will be watched, DXY will be watched .

the three will give a trade reason ,RBA played us by keeping OFFICIAL CASH RATE THE SAME 3.86% instead of the forecast of 3.6%.

AUD AND GOLD have something in common .

trading is 100% probability, apply risk management, no amount of grammar will stop liquidity sweep against a careless trader.

protect your capital.

Is Bitcoin Getting Ready to dump?

In this analysis, I looked at the weekly, daily, and 4-hour timeframes and found some key signals that suggest a major shift might be coming in Bitcoin’s movement over the next few days and weeks.

If you don’t want to get caught off guard by the next big move, make sure to watch the video all the way through!

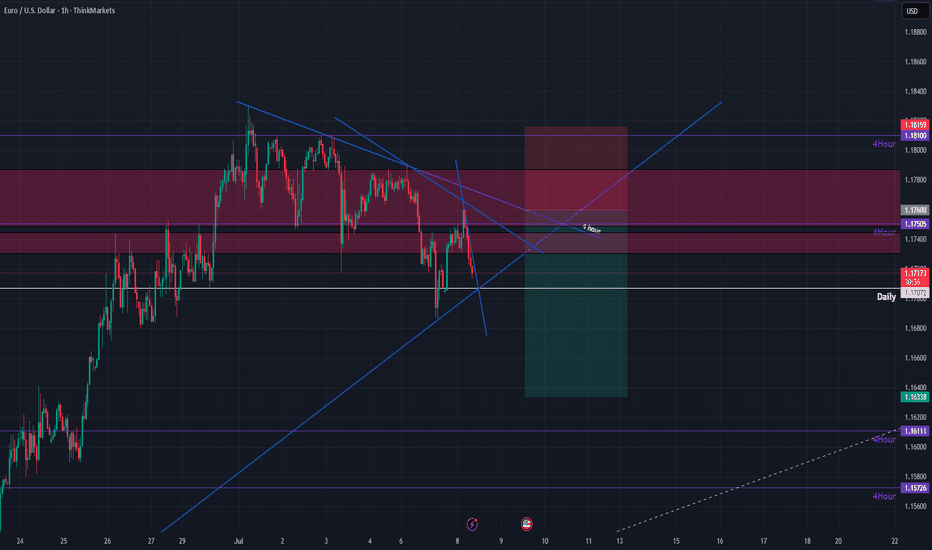

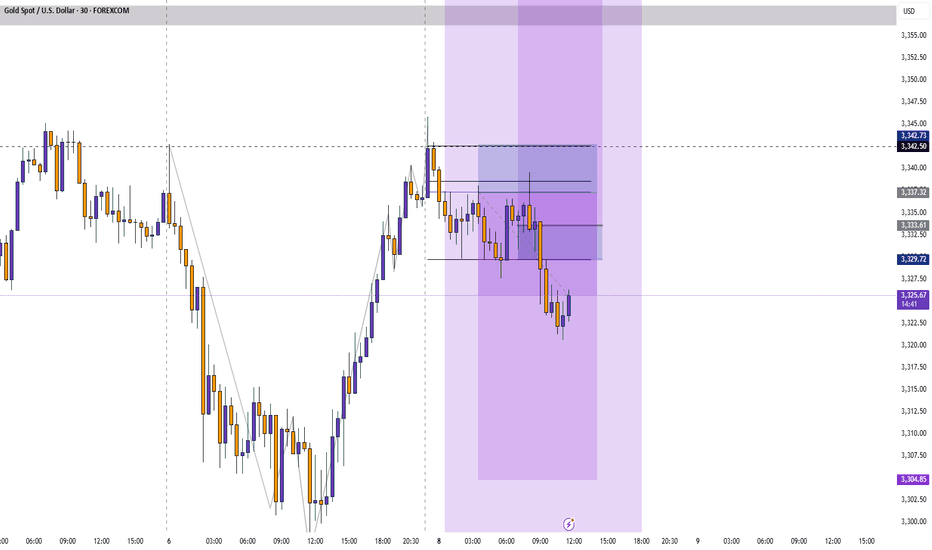

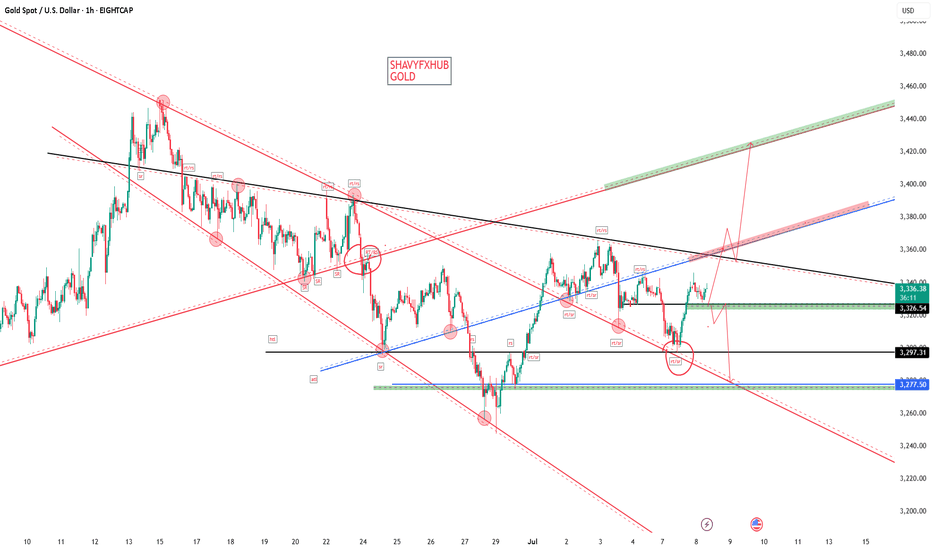

XAUUSD Outlook: How Risk Sentiment Could Shape the Next MoveI’m currently analysing XAUUSD (Gold) 🟡, which has come under bearish pressure 📉, showing signs of downside momentum. In the video 🎥, we also explore the inverse correlation between Gold and risk assets like the NASDAQ 📊.

Keep a close eye on NASDAQ movements—if risk assets break bullish 🚀, we may see further weakness in Gold. On the other hand, if risk sentiment shifts and risk assets break bearish 🛑, Gold could attract safe-haven demand and gain strength 💪.

We also dive into the price action, market structure, and pull up the volume profile 🧩. Gold is currently trading around the Point of Control (POC) ⚖️—a key level where significant volume has accumulated. A clean break above or below this area could act as a technical trigger for the next move 📈📉.

As always, this is not financial advice ⚠️—just my market view.

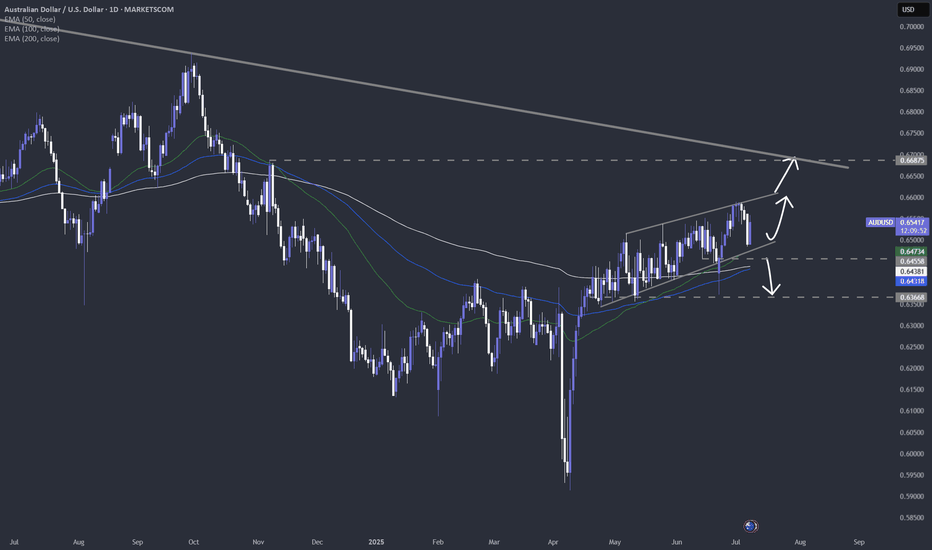

Surprise halt by the RBA. A positive for the AUD.After a surprise halt by the RBA, where the Bank kept the cash rate unchanged, MARKETSCOM:AUDUSD reversed sharply higher. Where it may go next? Let's dig in.

FX_IDC:AUDUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

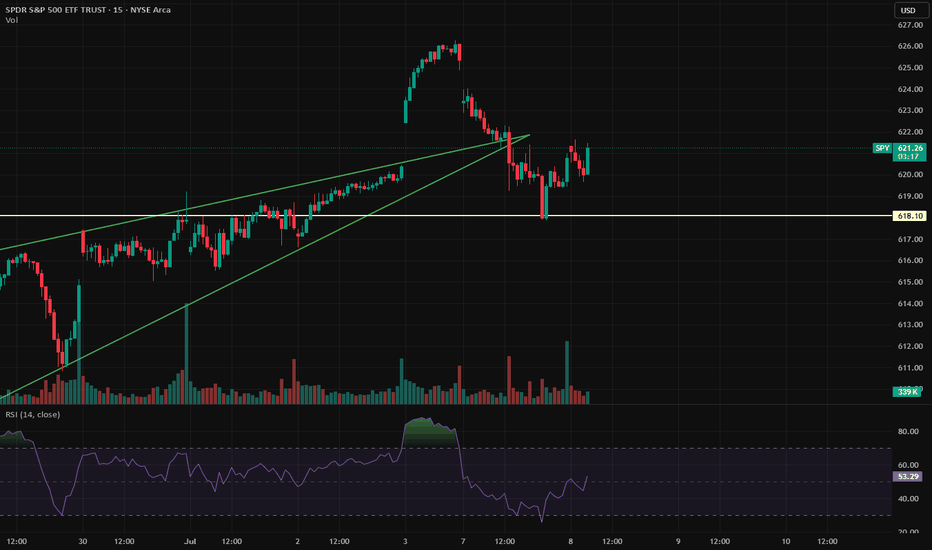

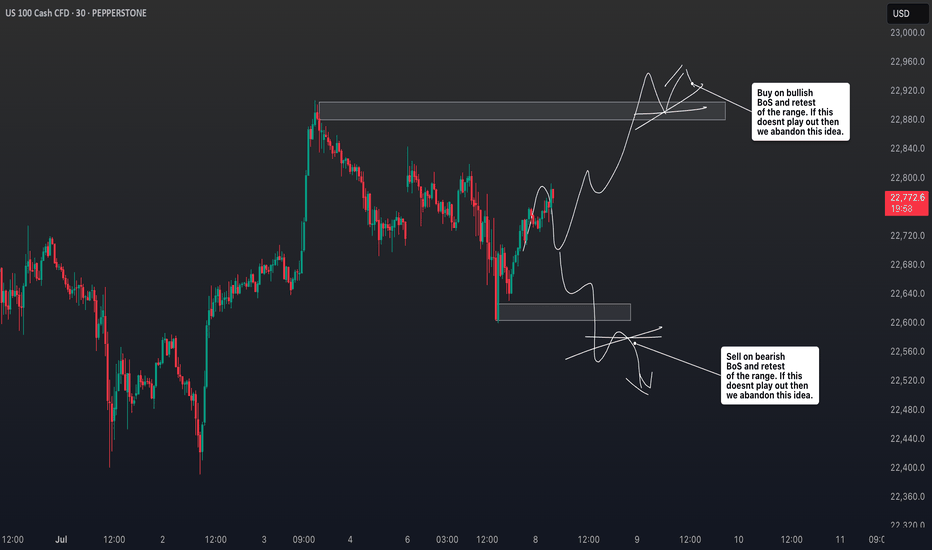

NAS100 Reading Market Structure: When to Trade and When to WaitI'm currently keeping a close eye on the NASDAQ 📉. Price has remained largely range-bound over the past few sessions and continues to show signs of pressure 🔻. While we've seen a short-term rally 🚀, it lacks the conviction and momentum typically seen in stronger trending environments 📊.

When comparing the current conditions to previous trend phases, the difference is clear. Structure is unclear, and there's no confirmation of sustained direction yet. As shown on the chart 📈, we previously saw strong bullish momentum followed by a sharp shift, suggesting indecision in the market 🤔.

In these situations, patience is key ⏳. It's just as important to know when not to trade as it is to know when to act 🎯. For now, I’m choosing to stay on the sidelines until a clearer trend develops.

Not financial advice ⚠️

GOLD GOLD ,the price of gold rose from a strong demand floor yesterday at 3296 to 3343 and corrected into 3326.6 today

if the correction into 3326.6 is upheld ,buyers could push into 3360-3357 if they can break 3343 supply roof .

my aim is 3423-3430 zone on long confirmation.

trading is 100% probability.

#gold