Community ideas

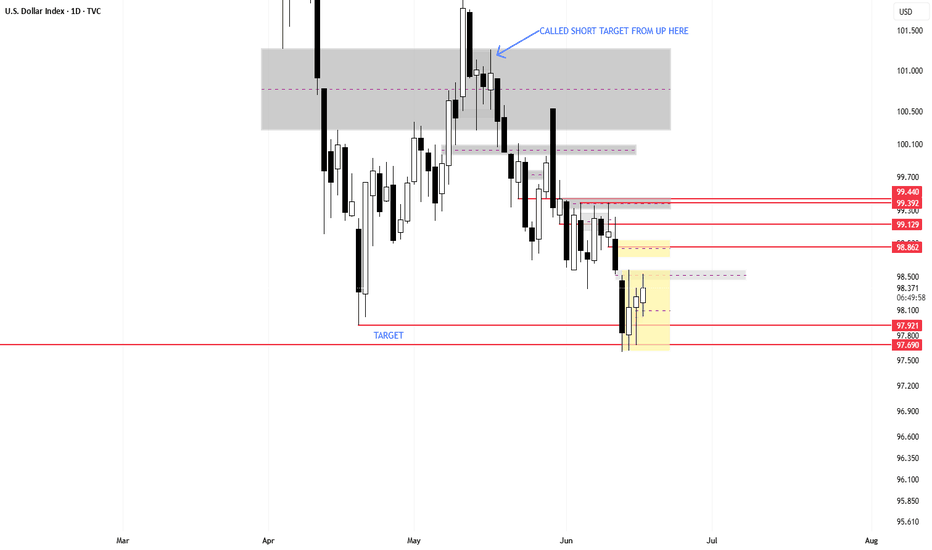

Trading Game of the day 17-MAY=2025Trading Plan of the day :-

1-bearish trend

2-(1-2-3)pattern

3-PDA :-30 m FVG

4-FVA:-which should give a chance for buyer to take its opportunity and then selling pressure increase in the bearish direction at the PDA

5-At Lower timeframe :-CISD with FVG

6-ARGUMENT:-

There was an FVA with FVG and OB bullish :-That make the rejection candles against the trend

These rejection candle was not significant because not only it is against the trend but there is no CISD against the trend and there is no FVG against the trend

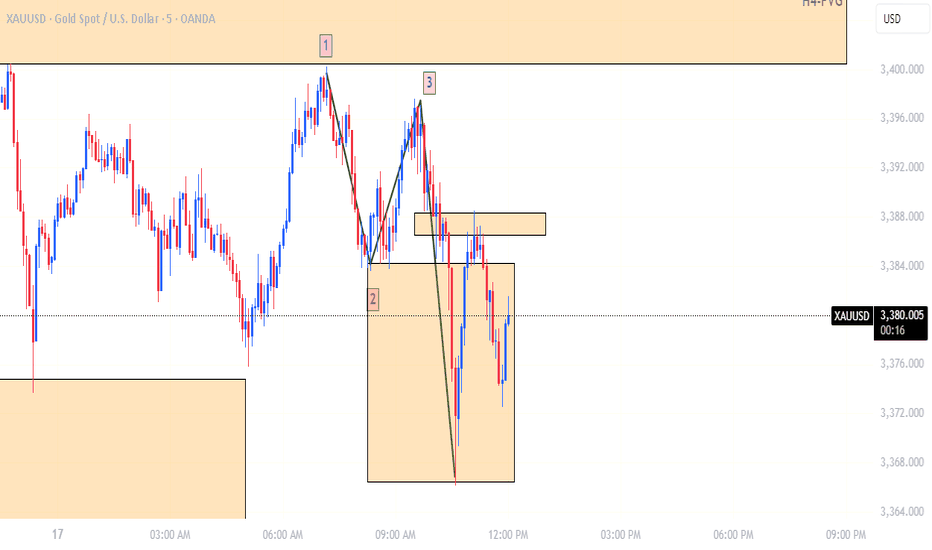

A review of multiple markets6.17. 25 an important change in oil to check out. we'll have to wait for some changes on gold to decide its direction.... it's not far below the high but it's not trading well... and I have some concern that the market could wash and rinse buyers and sellers.... so there needs to be more clarity for me to take a trade one way or the other.... it's no big deal but if you're not in a trade and it's not clear of its direction it's better not to take a trade until there's more clarity.

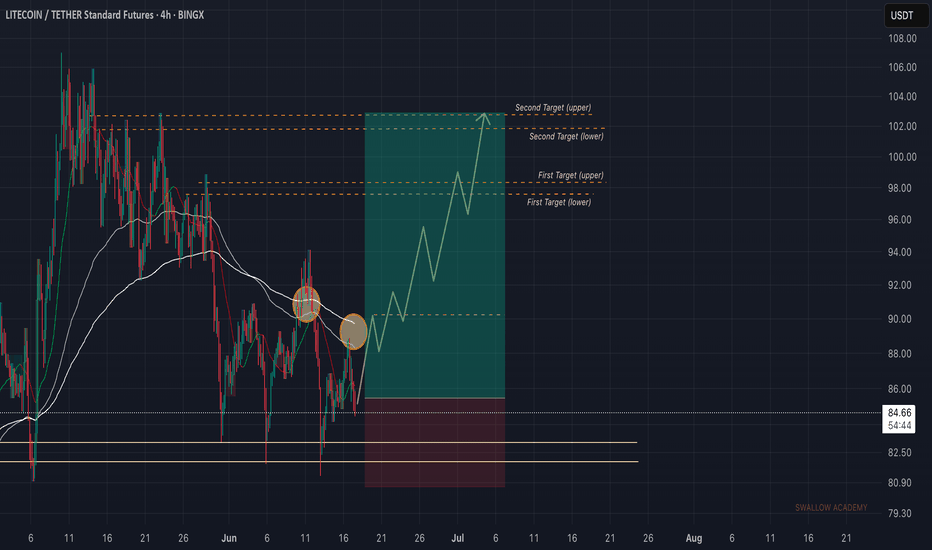

Litecoin (LTC): Looking Bad Now, But Has Good Potential Litecoin is in bad shape, where sellers are showing pressure, which could lead to bigger downward movement.

Despite that, we are still above the local neckline area, so we are still bullish, for now!

More in-depth info is in the video—enjoy!

Swallow Academy

TradingView Show: New Trade Ideas and The Leap TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- The upcoming Fed meeting and what policymakers might signal heading into the second half of the year

- Why the 10-year yield nearing 4.5% is important — and how to set alerts to stay ahead of key moves

- Summer trading strategies to navigate slower market conditions and spot emerging opportunities

- A closer look at Latin American equities, with names like Mercado Libre in focus

- The surprising strength in stocks that have doubled since the tariff-driven selloff

- How energy and oil markets are reacting to renewed geopolitical tensions in the Middle East

- And other trends that are shaping the broader investment landscape

Whether you're trading short-term setups or planning longer-term plays, this session will give you fresh insights and practical takeaways to help you stay prepared and informed through the summer months.

Bonus: Discover our latest broker integration update with TradeStation—now supporting equity options trading directly on TradingView. This upgrade brings advanced tools like the strategy builder, options chain sheet, and volatility analysis to your fingertips, making it easier to trade through uncertain market conditions.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

Disclosures from TradeStation:

tradestation.com/insights/etf-disclosures/

tradestation.com/important-information/

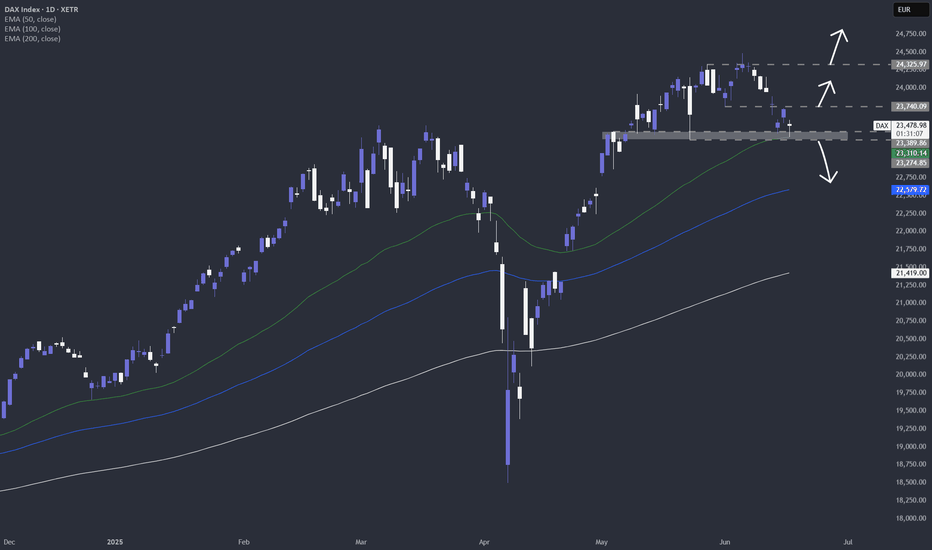

"Downside DAX" is what we will call it in July?Looking at the technical picture purely, we can see that weakness is starting to kick in. Will July be a negative month for DAX? Let's have a look.

XETR:DAX

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

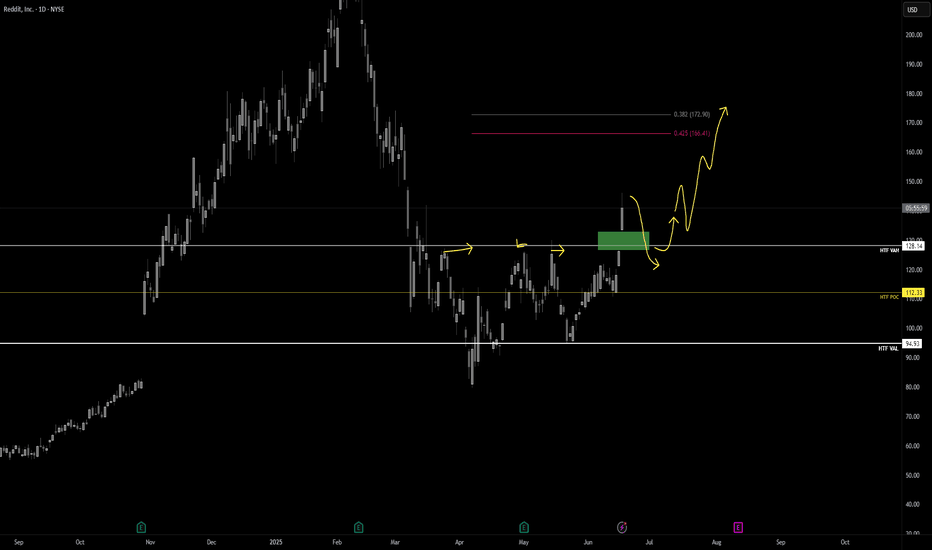

Reddit breaks out for bullish run I have been watching Reddit for a couple of weeks and identified that we had put in the .786 low from the correction since February and then formed a range that was well respected for the past 4 months .

In this video I highlight zones where i expect price to gravitate too and where a nice entry will be if you are looking to long reddit.

Tools used Fib suite , trend based fib , tr pocket , 0.786 + 0.382 and fixed range .

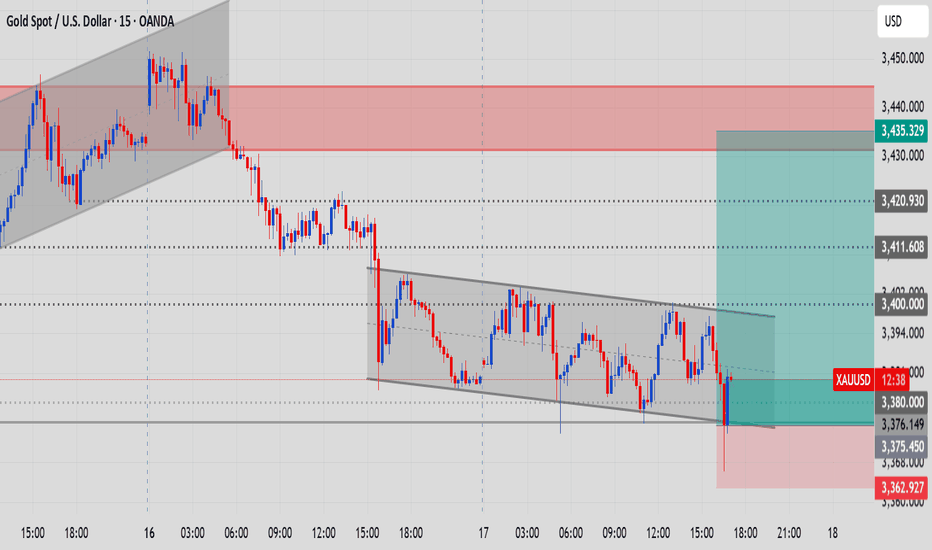

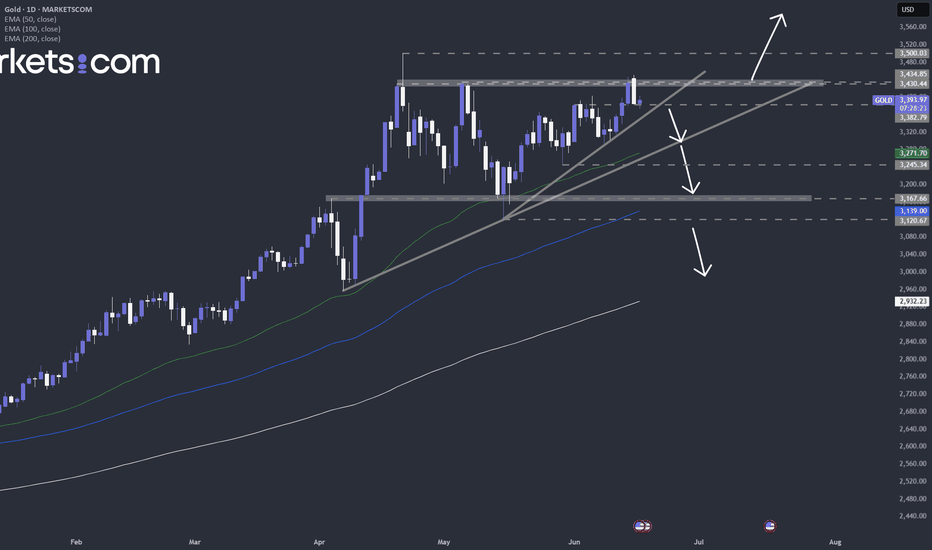

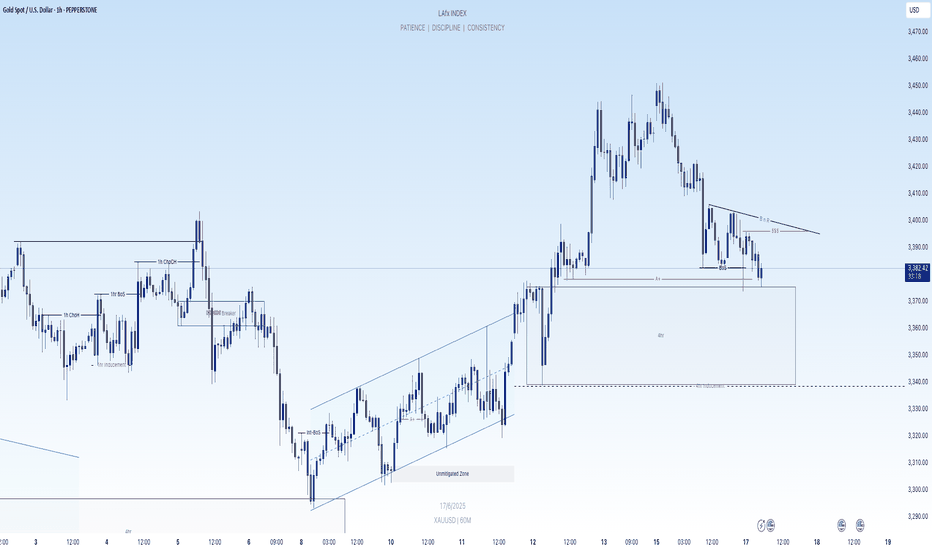

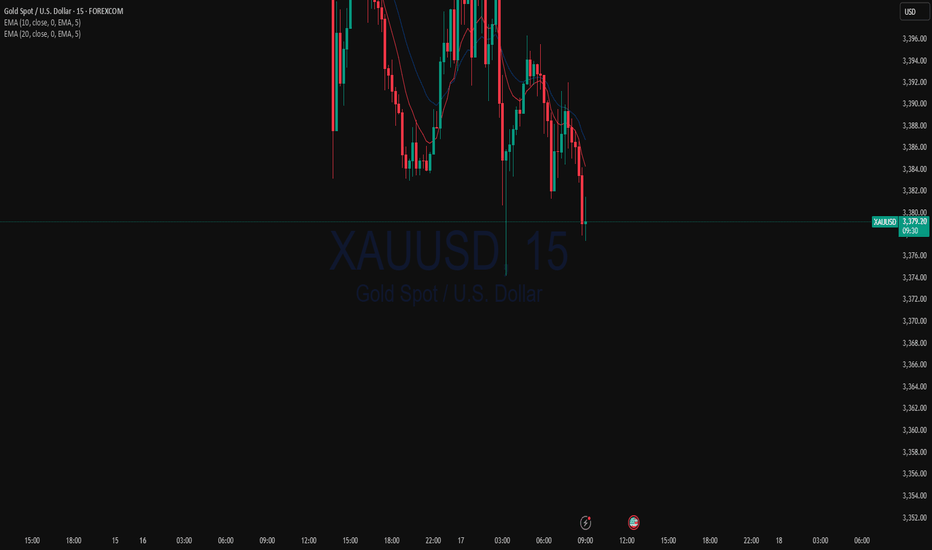

Is gold (XAUUSD) building up for a possible push higher?With the economic data sets, which we are getting and will be getting this week, all eyes on gold, and its possible move to the all-time high. Apart from this, the geopolitical tensions are also something that is fueling gold demand. But what are the technical saying? Let's take a look.

TVC:GOLD

FX_IDC:XAUUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

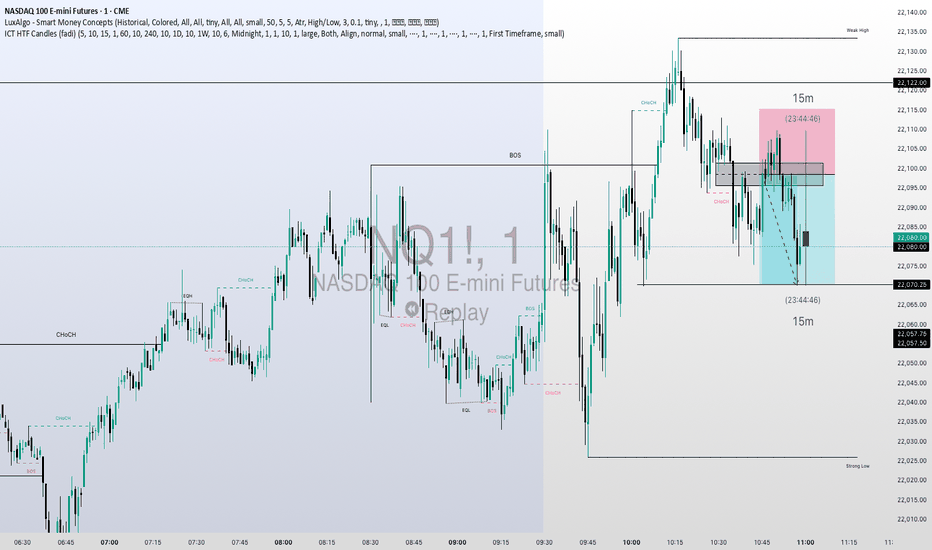

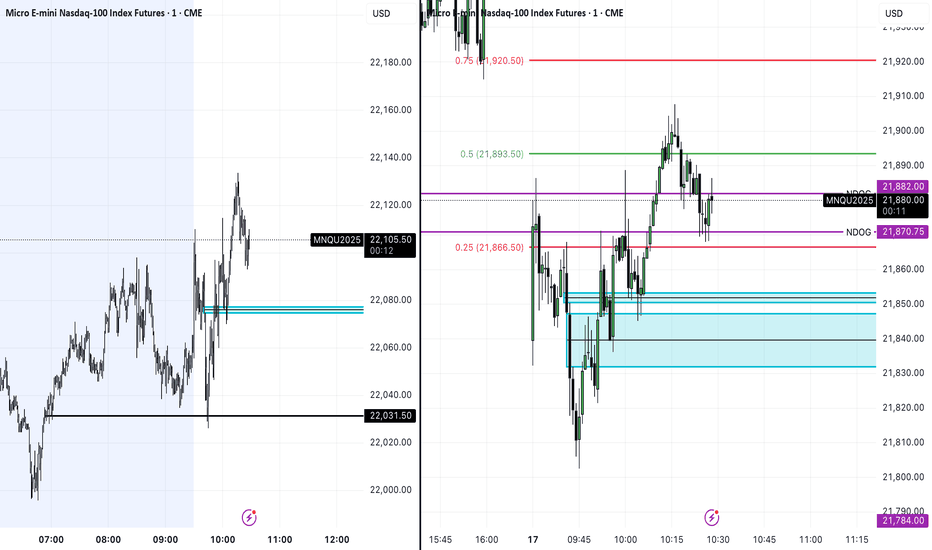

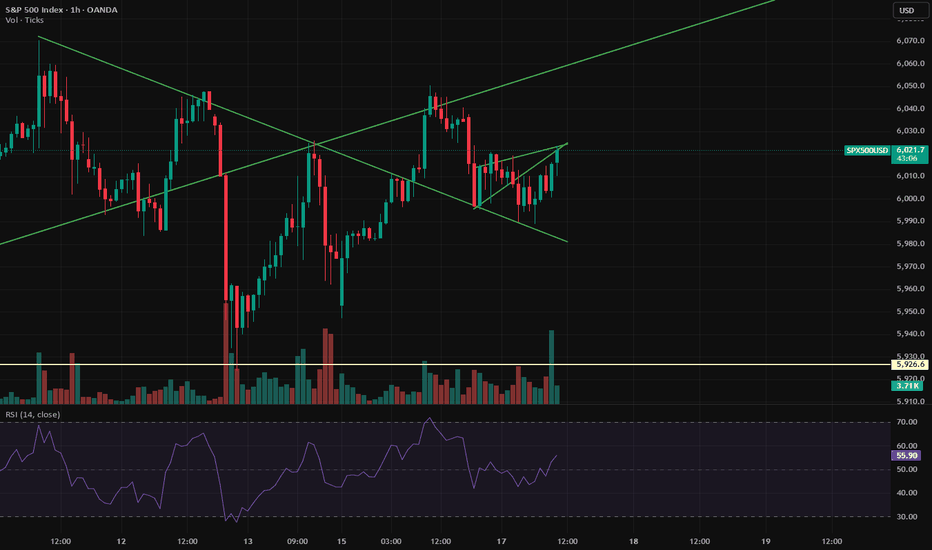

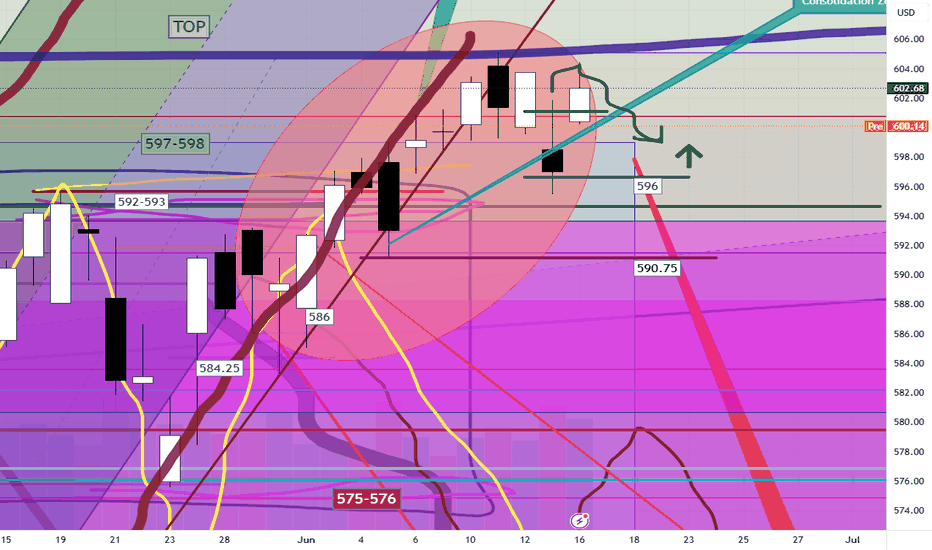

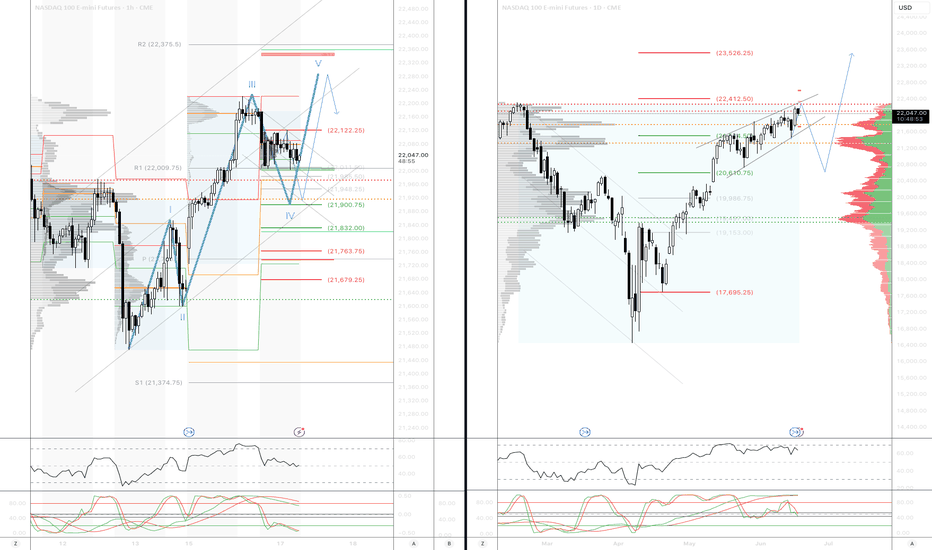

SPY/QQQ Plan Your Trade for 6-17: Top Resistance PatternToday's pattern suggests the SPY/QQQ will move into a type of topping pattern, attempting to identify resistance, then roll away from that resistance level and trend downward.

I suggest the news related to the conflict between Israel & Iran may continue to drive market trends with traders moving away from uncertainty near these recent highs.

Silver makes a big move higher. Gold will likely follow later this week or early next week.

BTCUSD moves into a sideways FLAGGING pattern - possibly attempting a BIG BREAKDOWN event over the next few weeks.

Overall, the markets look like they are poised for a very big move - just waiting for the GREEN LINK (GO).

Stay safe. Protect capital and HEDGE.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

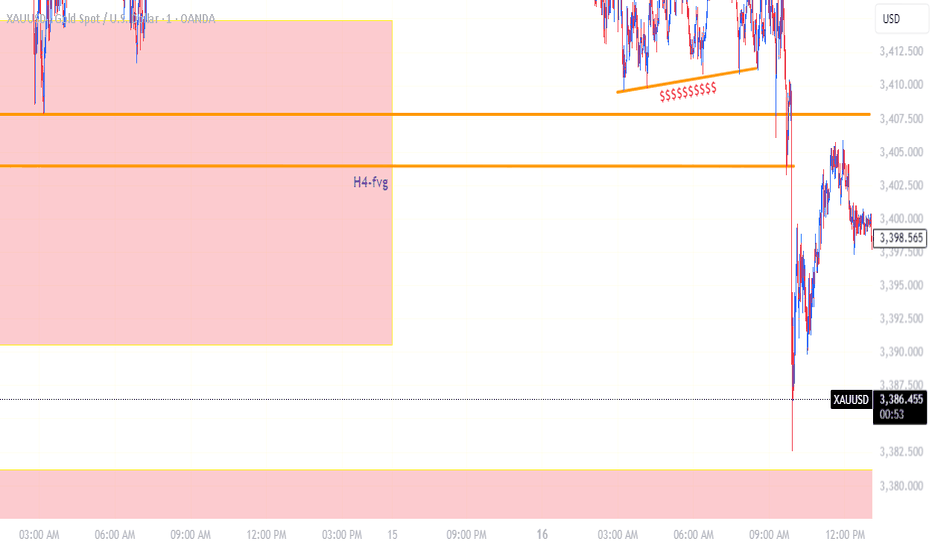

Trading Game of the day 16-MAY-2025Trading Plan:-

1-PDA:-swing point of the week

2-Rejection block from the swing point

3-CISD

4-FVG :-2 fvg.s on H4,H2 and H1

5-AMD on the NY session :-The price take on the LQ from above and move down

6-Then the price move down to the target (D-FVG)

My argument is followed by another video

Thank You

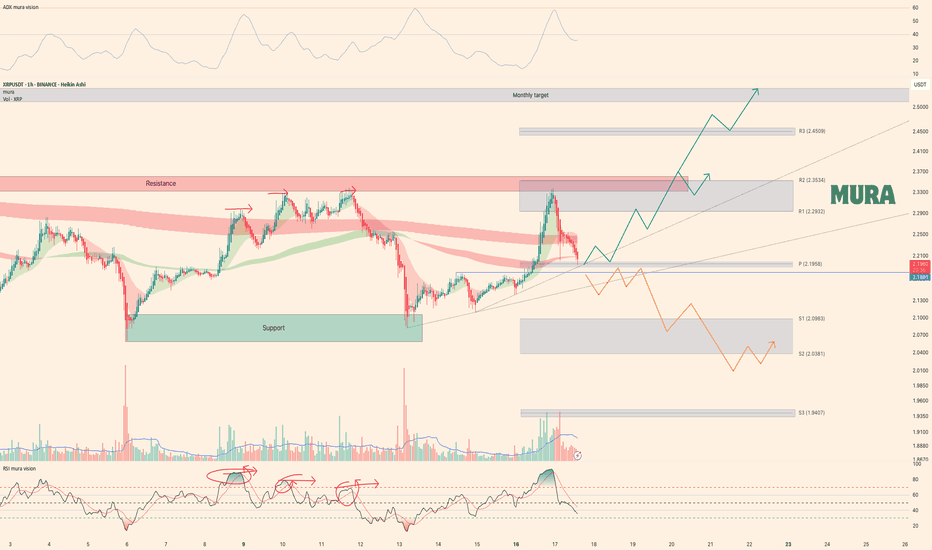

Weekly trading plan for XRP BINANCE:XRPUSDT Price has reached the weekly pivot point, so now it is important to understand the further reaction. Several trend lines can be seen on the chart. If the lower trend line and the level of 2.18 are broken, the price will probably continue its downward movement to the support zone, but it will already renew the local bottom.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

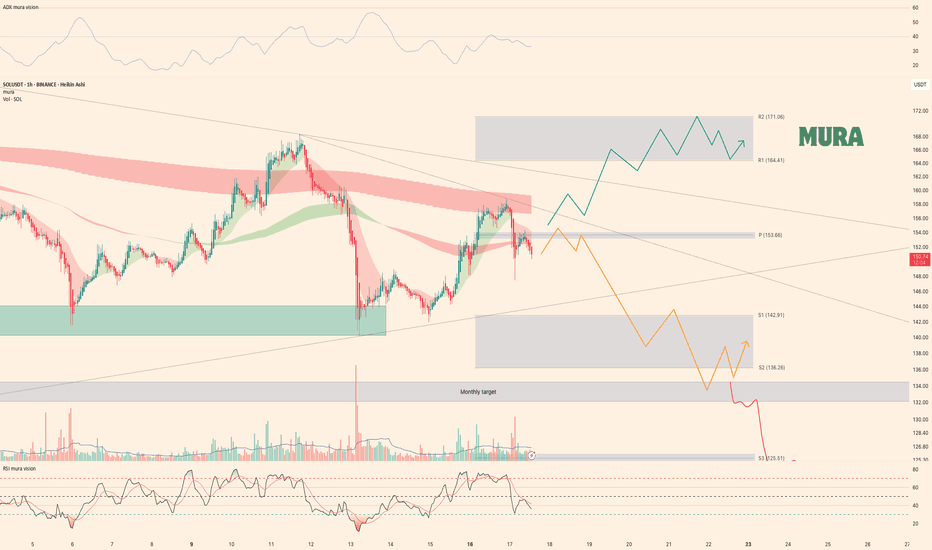

Weekly trading plan for SolanaBINANCE:SOLUSDT The price is already below the weekly pivot point. After updating the last bottom, the price may continue its downward movement. There are some level crossings so it is possible to reach them. More details in the video idea

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

GOLD The relationship between gold, the 10-year U.S. Treasury bond yield, and interest rates has traditionally been a key focus for investors. Historically, gold prices and bond yields have shown a strong inverse correlation, but recent years have seen some deviations due to shifting macroeconomic and geopolitical dynamics.

1. Gold and 10-Year Bond Yield

Inverse Correlation:

For nearly two decades, gold and the 10-year Treasury yield moved in opposite directions: rising yields made bonds more attractive relative to gold (which pays no interest), causing gold prices to fall, and vice versa.

Recent Divergence:

Since 2022, this relationship has weakened. Despite rising yields, gold prices have remained strong or even increased, largely due to unprecedented central bank gold buying and heightened geopolitical risks.

Current Data:

As of June 16, 2025, the 10-year Treasury yield is approximately 4.46%, up from 4.20% a year ago. Gold prices remain elevated, reflecting persistent demand despite higher yields.

2. Gold and Interest Rates

Opportunity Cost Effect:

Higher interest rates increase the opportunity cost of holding non-yielding gold, typically leading to lower gold prices. When rates fall, gold becomes more attractive, supporting price gains.

Real Interest Rates:

The most relevant metric is the real interest rate (nominal rate minus inflation). Gold’s correlation with real yields is strongly negative (historically around -0.82): when real yields fall or turn negative, gold prices rise as investors seek alternatives to low or negative real returns.

Central Bank Policy:

Expectations of rate cuts by major central banks, such as the Federal Reserve, tend to boost gold prices by lowering real yields and the dollar’s appeal.

Real interest rates (adjusted for inflation) are the most important driver for gold’s price direction.

As of June 2025, the 10-year Treasury yield is 4.46%, with markets watching for potential rate cuts that could further support gold prices.

Conclusion:

While gold traditionally moves opposite to bond yields and interest rates, the relationship has become more complex in 2025. Central bank demand, geopolitical risks, and real interest rates now play a larger role in gold price dynamics alongside traditional monetary policy factors.

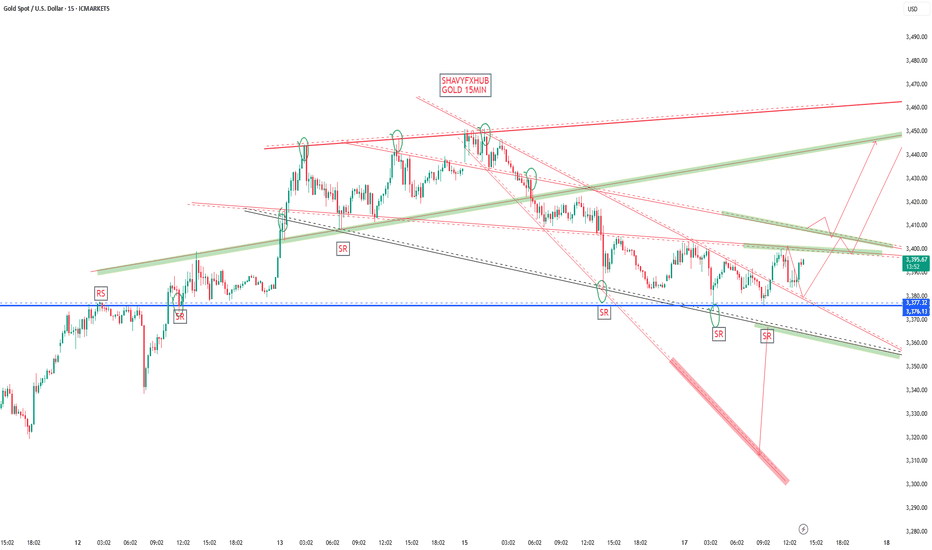

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.