Community ideas

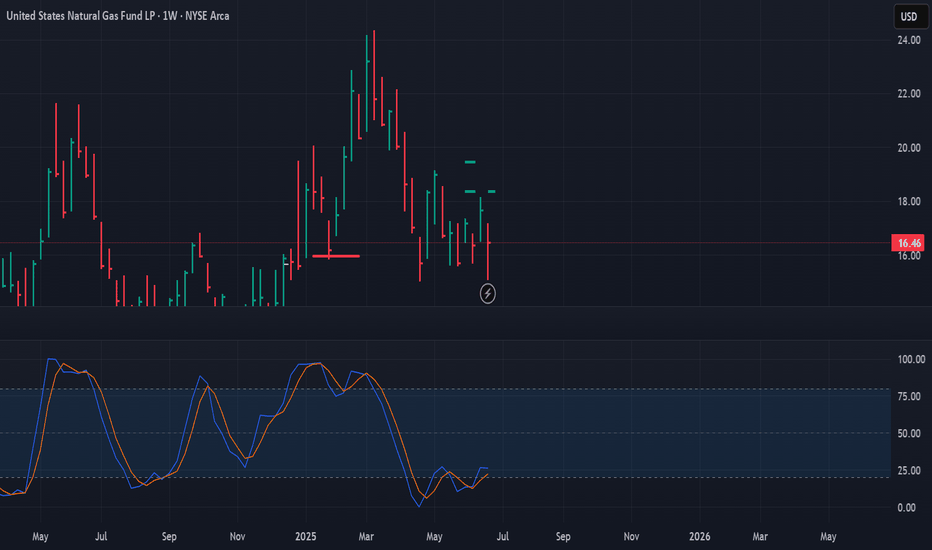

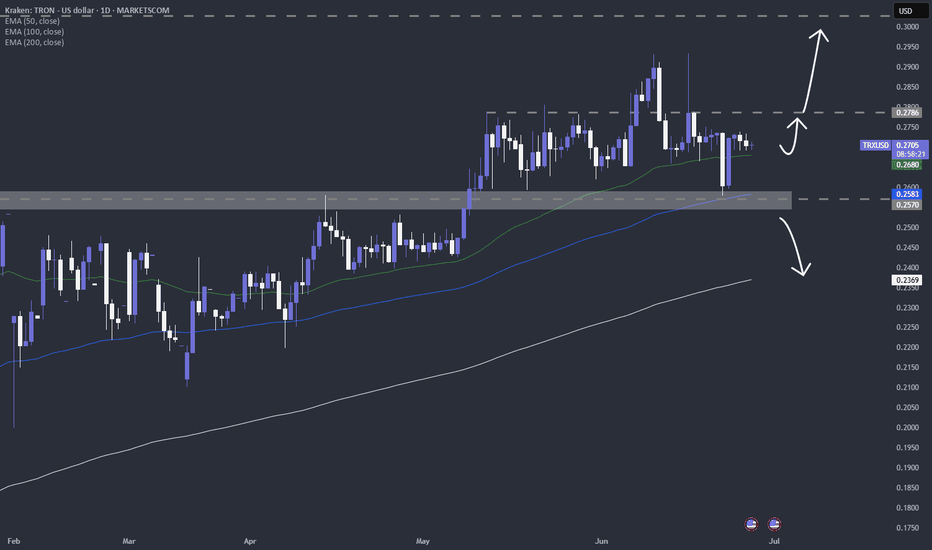

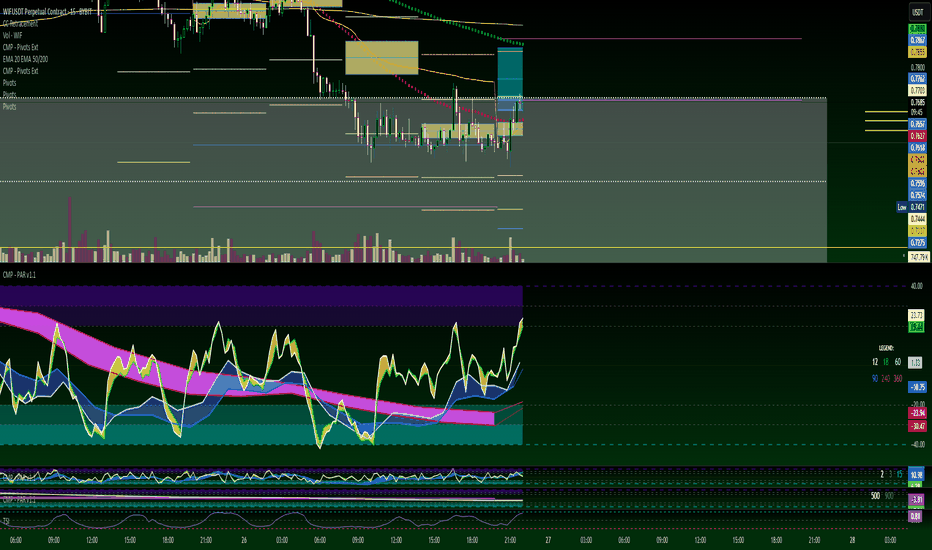

TA on Litecoin, Ripple, Dogecoin, Polkadot, TronQuick TA on Litecoin, Ripple, Dogecoin, Polkadot, Tron. What do you think?

CRYPTO:LTCUSD

CRYPTO:XRPUSD

CRYPTO:DOGEUSD

CRYPTO:DOTUSD CRYPTO:TRXUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

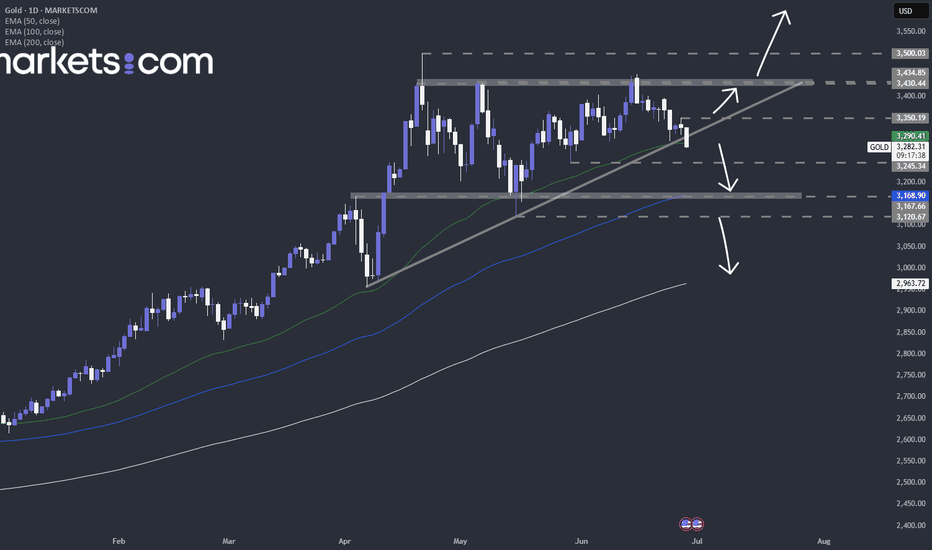

Is gold in an ascending triangle, or in a wider range?A quick technical piece on TVC:GOLD . What are your thoughts?

MARKETSCOM:GOLD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

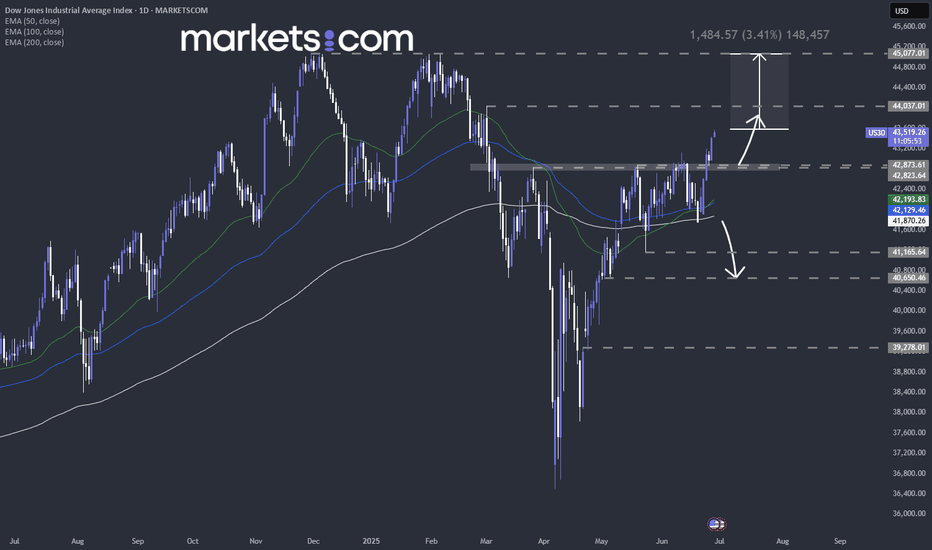

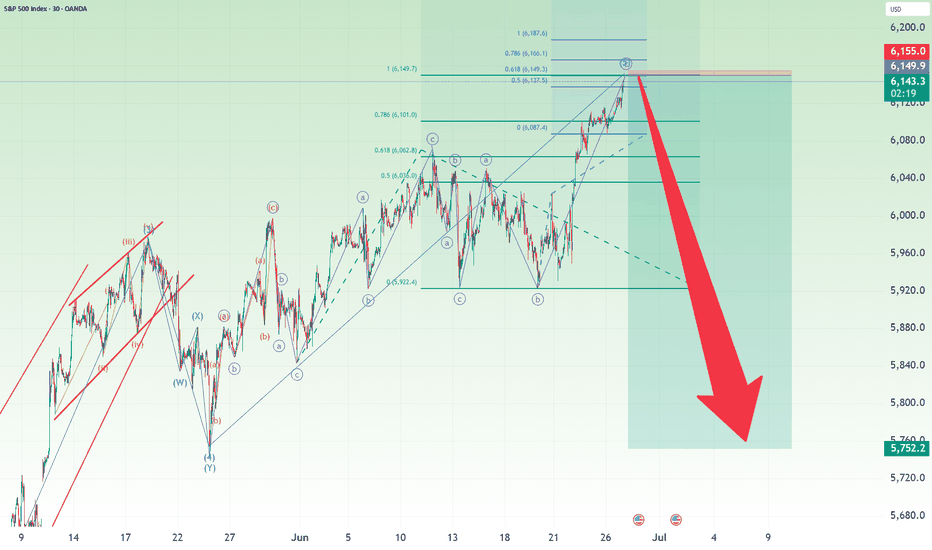

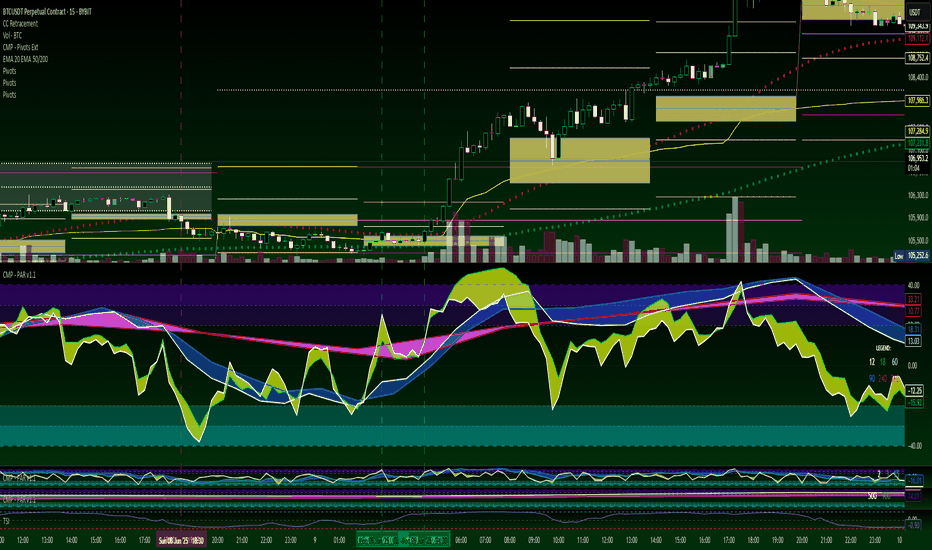

PCEs & attacks on PowellWe are carefully monitoring the PCEs today, to see, "wins" this small battle in the rate-lowering war. Let's dig in.

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

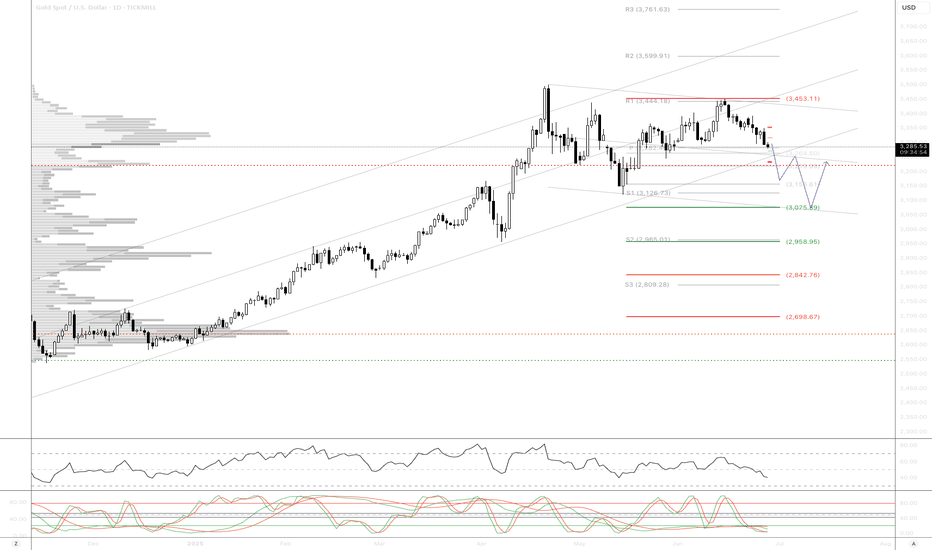

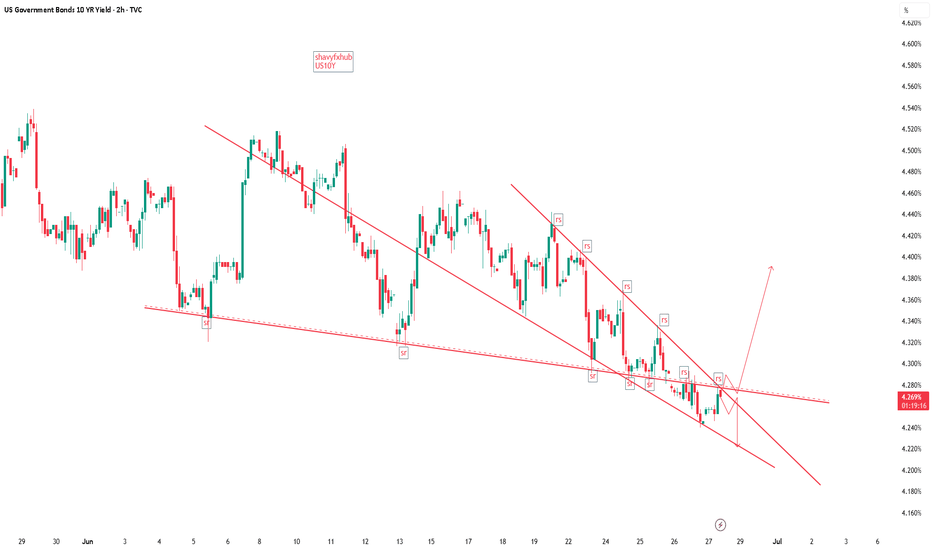

US GOVERNMENT 10 YEAR BOND YIELD.The correlation between the US 10-Year Treasury yield (US10Y) and gold prices is historically inverse but has shown periods of divergence due to shifting market dynamics

1. Typical Inverse Relationship

Gold and US10Y yields traditionally move in opposite directions due to:

Opportunity Cost: Higher yields increase the cost of holding non-yielding gold, pressuring prices.

Real Interest Rates: Gold tends to fall when real yields (nominal yield minus inflation) rise, as seen in pre-2024 data.

2. Recent Deviations and Drivers Since 2024, this correlation has weakened or reversed under specific conditions:

Geopolitical Turmoil makes Positive correlation (both rise)us10y and gold ,eg Russia-Ukraine war, Middle East tensions, and U.S.-EU tariffs drove simultaneous surges in yields and gold as dual safe havens.

De-Dollarization,Gold decouples from yields as mejor Central banks (e.g., China, Russia) bought gold aggressively, offsetting yield-driven pressure.

3. Yield Level: US10Y at 4.26%,

Correlation Status: Weakly inverse, but fiscal risks (e.g., U.S. deficit, trade policies) could reignite positive links.

Key Influencers Moving Forward

Fed Policy: Expected rate cuts (2×25 bps in 2025) may weaken yields, boosting gold.

Inflation Expectations: Sticky inflation could sustain gold’s appeal despite yield fluctuations.

Geopolitics: Escalations in trade wars or conflicts may re-tighten the positive correlation.

Summary

While the US10Y-gold correlation remains fundamentally inverse, recent structural shifts—geopolitical stress, fiscal uncertainty, and de-dollarization—have driven periods of alignment.

#dollar #gold

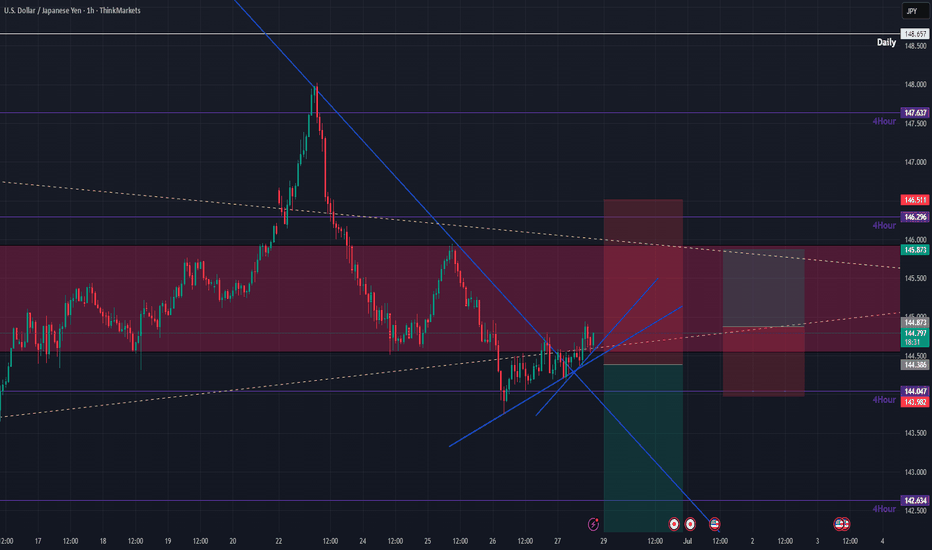

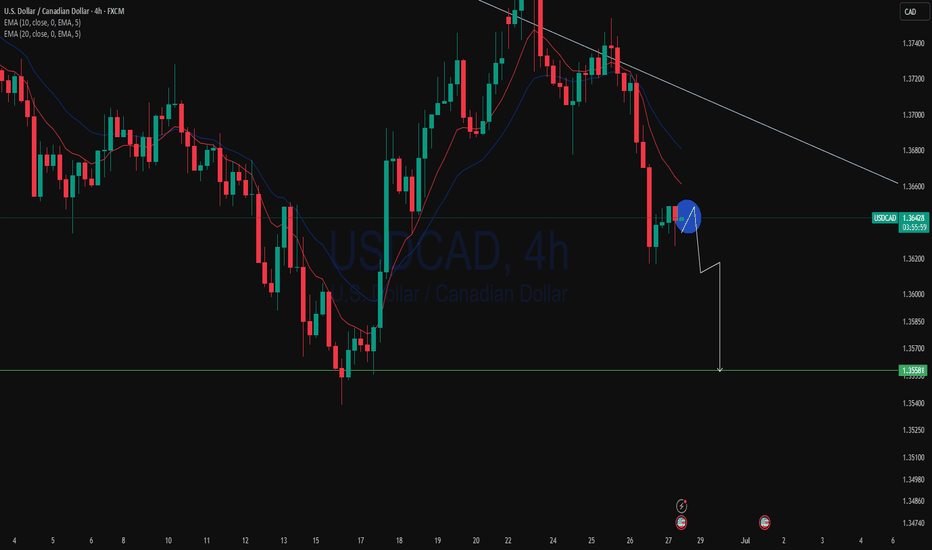

USDJPY and USDCAD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

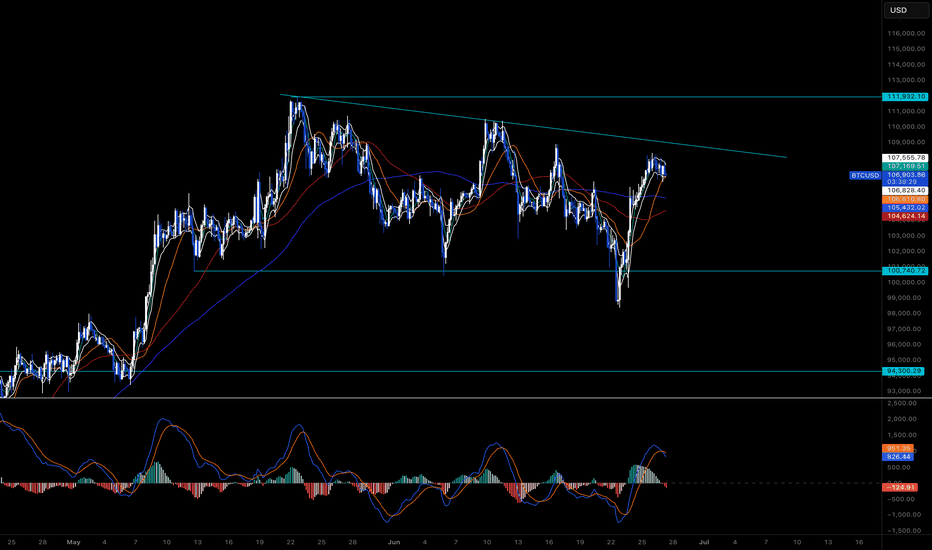

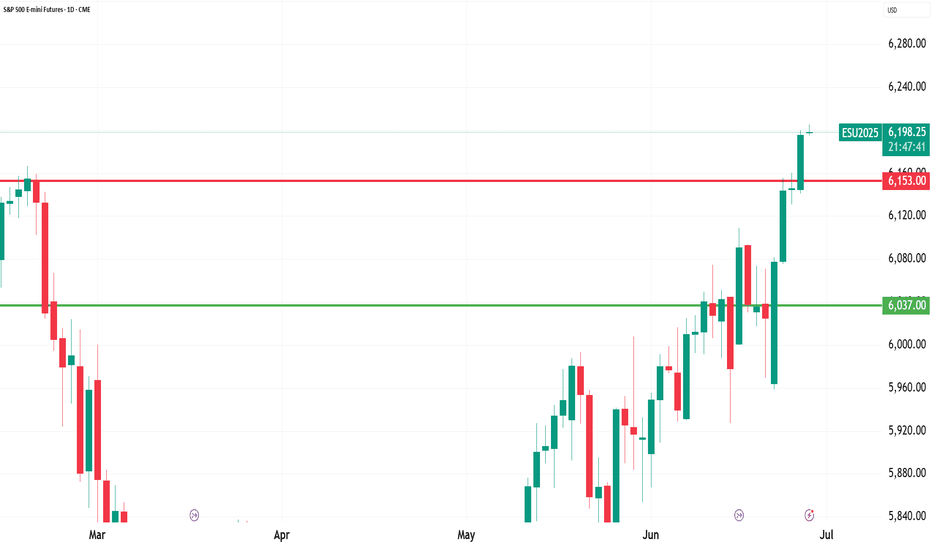

“DXY at 3-Year Low | Gold Slips, BTC Stalls – What PCE Data Meann this week’s Market Recap, we break down the key moves across the US Dollar Index (DXY), Gold (XAUUSD), and Bitcoin (BTCUSD) — and how they’re all being shaped by rising Fed uncertainty and looming U.S. inflation data.

🔹 DXY is hovering near 3-year lows as political pressure and expectations of Fed rate cuts weigh on sentiment.

🔸 Gold is slipping near 4-week lows as Middle East tensions ease and risk appetite returns.

🔹 Bitcoin remains flat but poised for a breakout, with macro data in the driver's seat.

We explain how each market is reacting, what traders are pricing in ahead of the upcoming PCE inflation data, and how to position yourself in the week ahead.

📌 Covered in this recap:

Market sentiment shifts and key news drivers

Practical insights for interpreting price action

What to watch in next week’s economic calendar

📊 Stay informed, stay prepared.

👉 Like, follow, and comment if you found this helpful. Let’s trade smart.

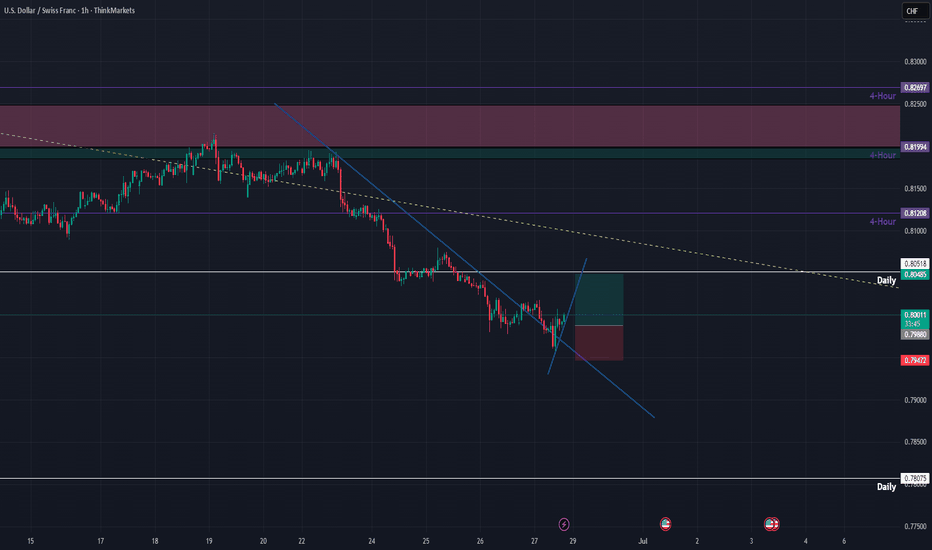

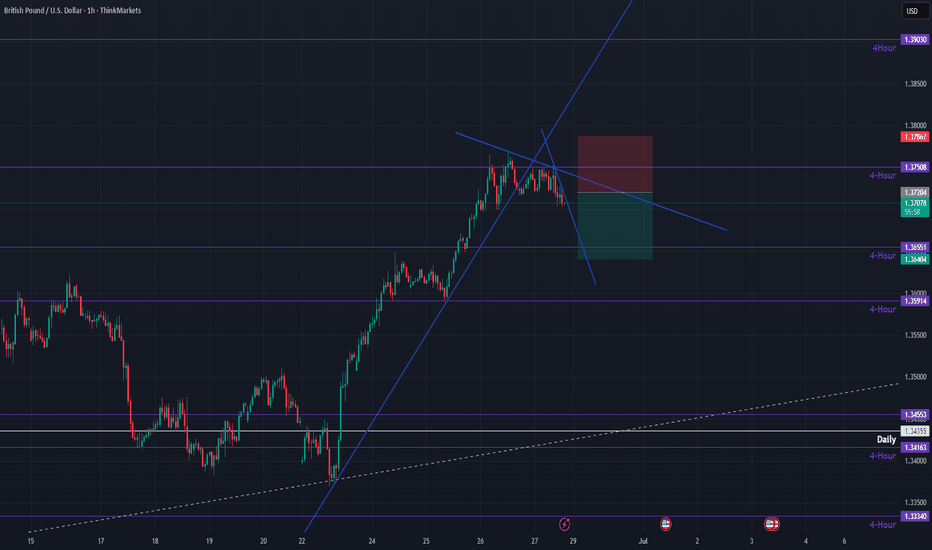

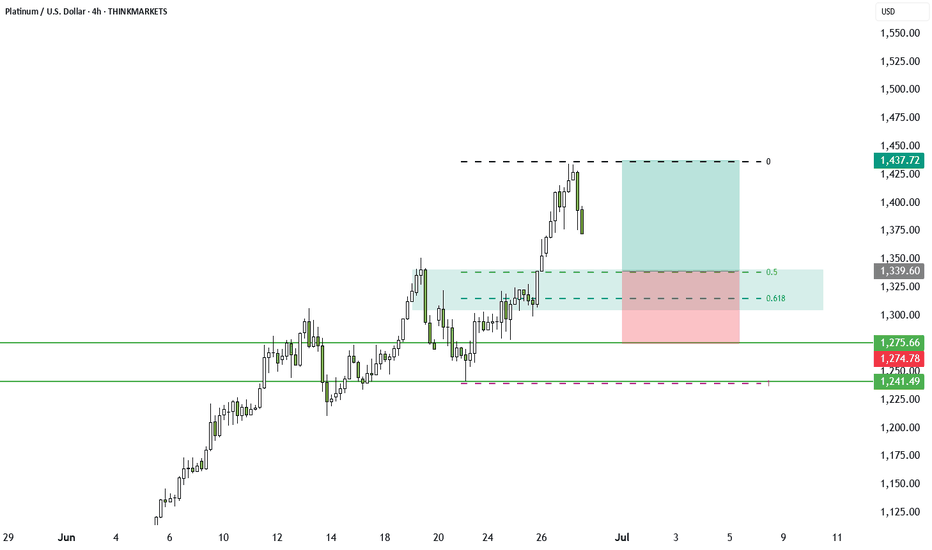

Platinum trade review and new setupLast week we called the dip in Platinum. In this video, I break down how the trade idea played out, the different ways you could have entered, and what to watch next. We also look at the weekly chart, Fibonacci levels, and key support zones to prepare for the next move. Still bullish, but execution matters.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

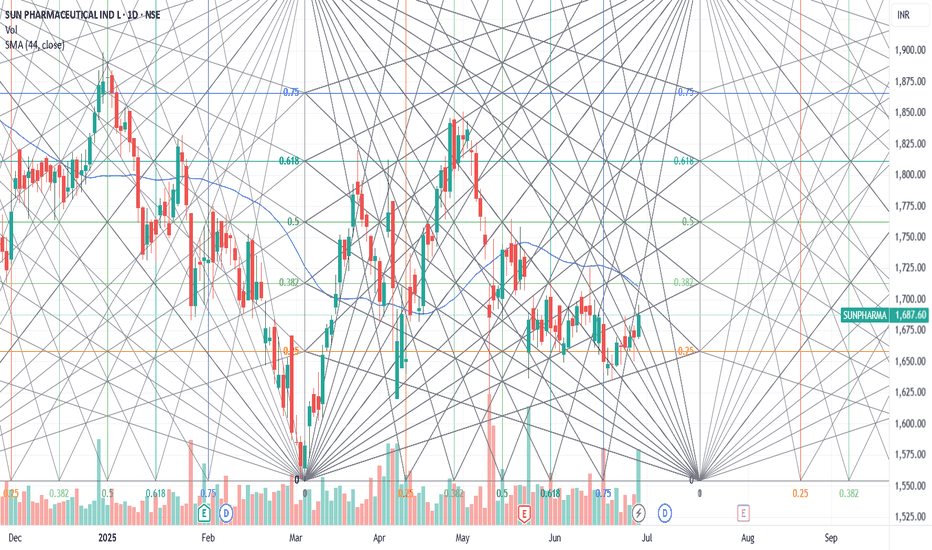

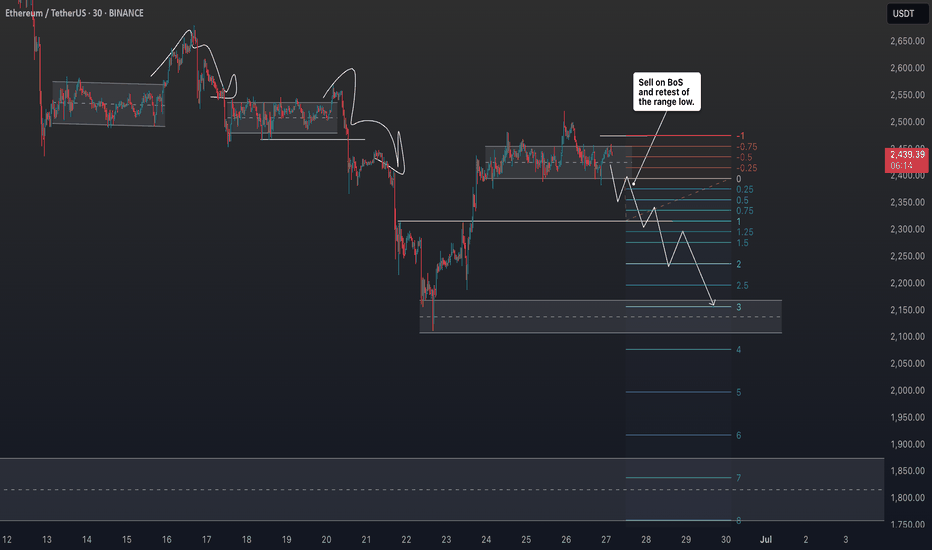

Inverse Head and Shoulders on Ethereum: Short Opportunity ETH?I'm currently watching Ethereum , and things are starting to look interesting.

We’re seeing early signs of a potential break in structure to the downside, and I’m closely monitoring a bearish inverse head and shoulders pattern. On the 30-minute timeframe, I’m waiting for a clear break of market structure within the current range before considering a short entry.

Stop loss would be placed above the range, with the target outlined in the video.

This is not financial advice—please trade responsibly and always manage your risk.

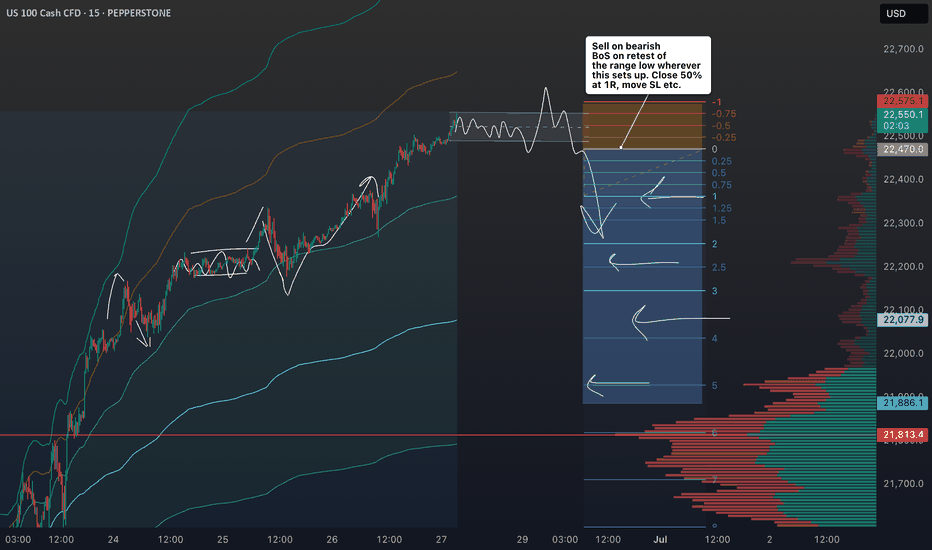

Smart Friday Trades: NASDAQ Setup and Key Levels to Watch NAS100📊 NASDAQ US100 Analysis – Friday Setup

I'm currently watching the NASDAQ closely 👀. The NAS100 looks significantly overextended 📈, and with it being the end of the week, we often see price action push into the weekly high before pulling back into the weekly close 🔁.

This is a pattern I’ve seen play out many times during the New York session on Fridays 🗽📉.

💡 Here’s my suggestion:

Wait for today’s data release 📅 to finish. If price ranges and then breaks market structure to the downside, keep an eye out for a short entry on the retrace and retest of the range low.

🎯 Your targets and stop loss are outlined clearly in the video, so make sure to watch it through.

⚠️ Trade sensibly, manage your risk, and don't rush into anything.

I'd love to hear your thoughts in the comments 💬

Have an awesome day and I’ll see you in the next one! 🚀

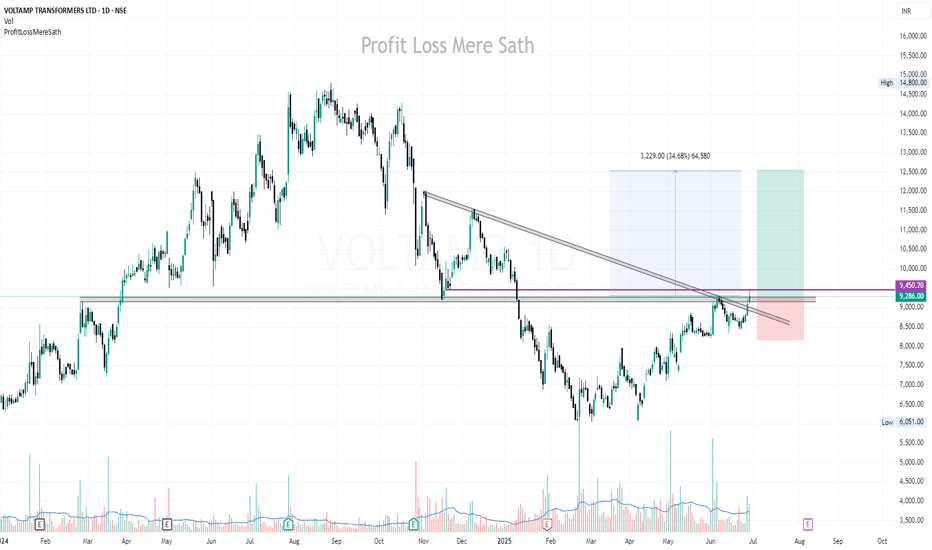

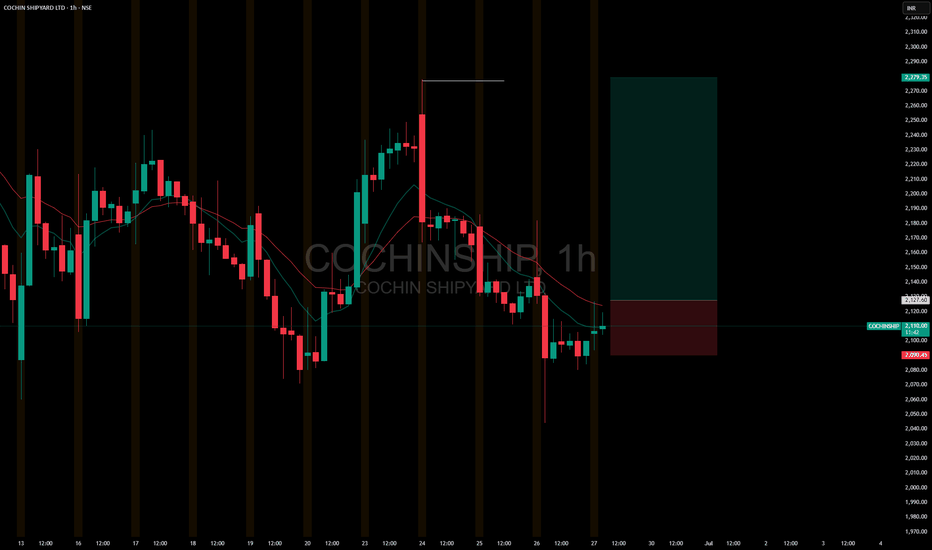

WHATS YOUR VIEWS ON COCHIN ?Hello traders , here is the full multi time frame analysis for this STOCK, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below.I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

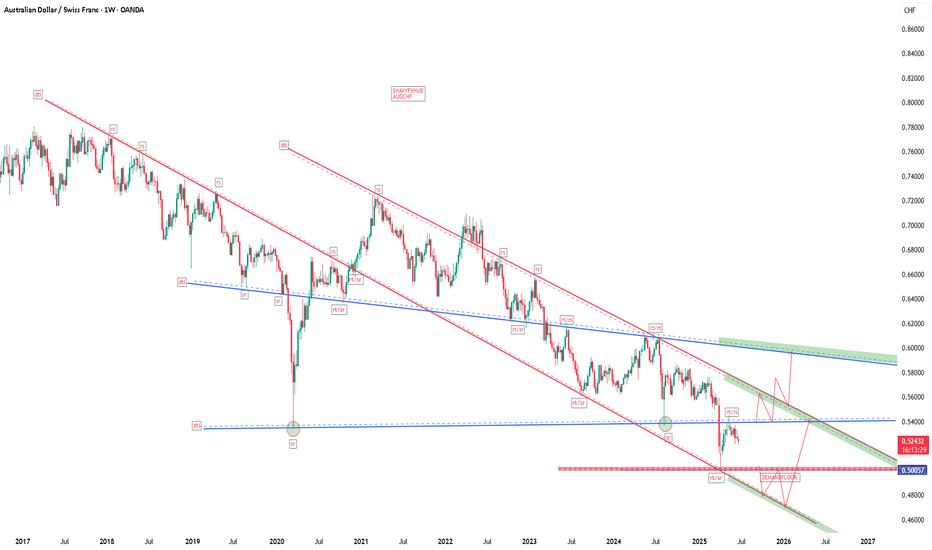

AUDCHFChina’s offshore gold vault strengthens its role in global gold pricing, potentially supporting AUD through higher gold demand. However, CHF’s safe-haven status and Switzerland’s stable fiscal policies could counterbalance this, especially if global risk aversion rises.

China's offshore gold vault in Hong Kong and its push for yuan-based gold pricing could indirectly impact AUD/CHF. As Australia is a major gold exporter, rising gold prices (influenced by China's de-dollarization efforts) may support the AUD. However, the CHF remains a safe-haven currency, gaining strength during global uncertainty, which could pressure AUD/CHF downward.

The current RBA (Reserve Bank of Australia) cash rate is 3.85%, and the SNB (Swiss National Bank) policy interest rate is 0.00%. The SNB recently lowered its key interest rate by 25 basis points to 0% on June 19, 2025. The RBA last adjusted its cash rate in May, lowering it by 25 basis points to its current level.

Impact on AUD: The RBA’s steady rate policy supports AUD stability but limits aggressive appreciation unless inflation spikes or commodity exports (e.g., gold, driven by China’s vault) boost economic outlook.

Outlook: The RBA may hold rates steady through 2025 unless China’s demand for Australian commodities (e.g., iron ore, gold) significantly increases, potentially strengthening AUD.

Swiss National Bank (SNB) 0% rate

Impact on CHF: The low rate reinforces CHF’s safe-haven appeal, especially amid global uncertainties (e.g., US trade policies, geopolitical tensions). This strengthens CHF, capping AUD/CHF upside.

Outlook: The SNB is likely to maintain low rates, with potential cuts if deflationary pressures emerge, further supporting CHF strength.