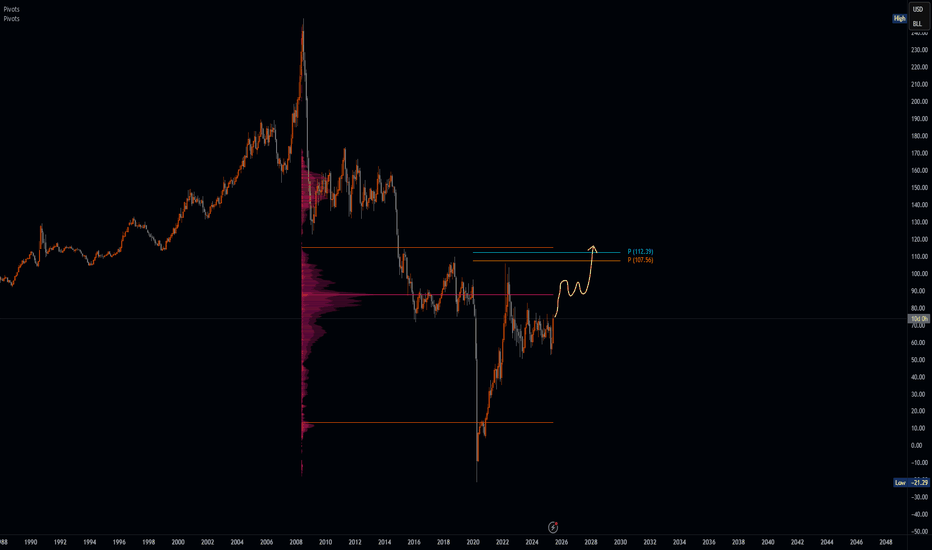

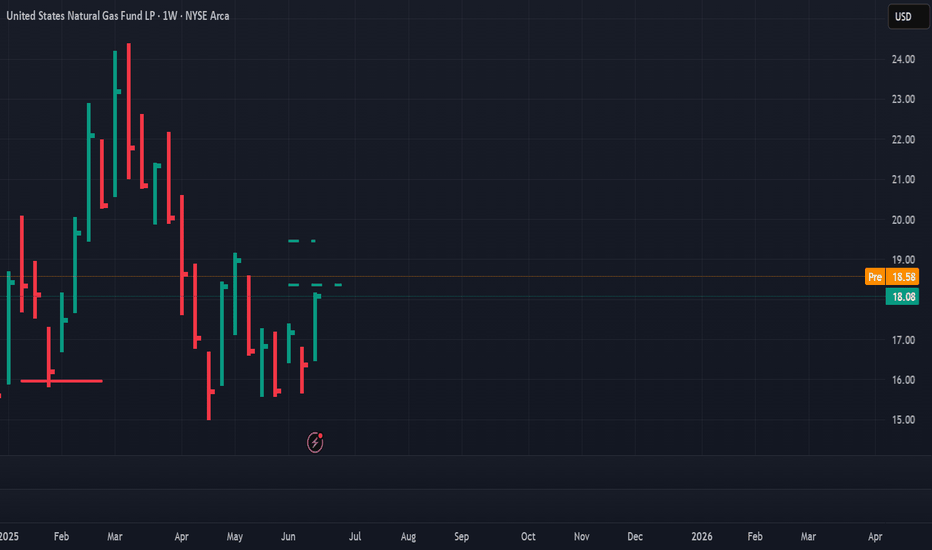

$100 a barrel coming soon for Crude oil futures In this video we focus on the current accumulation in the oil chart and the prospect of higher prices ahead .

I highlight how the respect of the previous quinquennial pivots gave us a 45% move to the upside in the past 8 weeks .

Looking ahead on the monthly timeframe we have the following confluences above the current price of $75 .

Above the current pa we have the point of control at $ 88 and the avwap at $97, if we can reclaim the poc I think we will continue to push up to the fib levels that I have mentioned in the video.

In addition to the above we also have the decennial pivots at $107/$112 alongside the value area high .

All of this validates for me why oil will be pushing back up throughout the course of the year .

Tools used in the video

Tr pocket , pivots , fived range volume profile and fib expansion

Community ideas

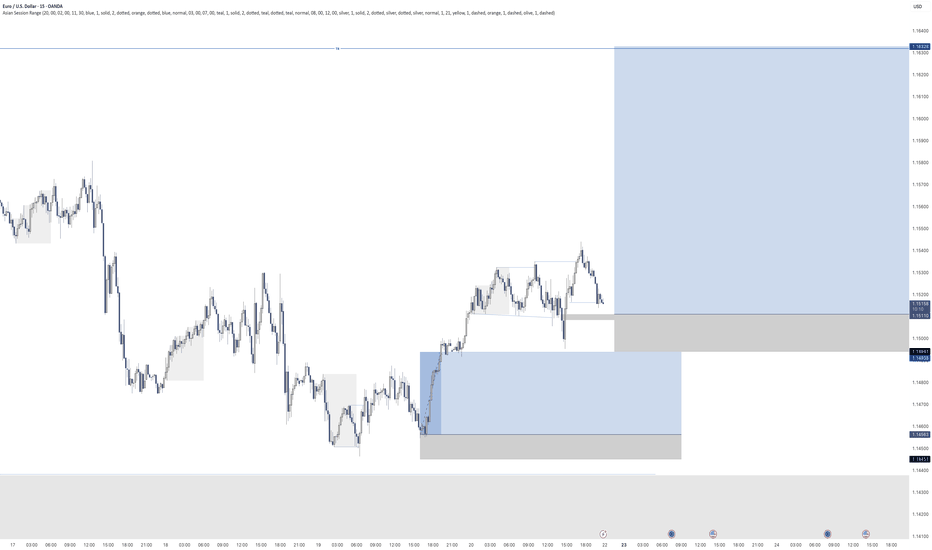

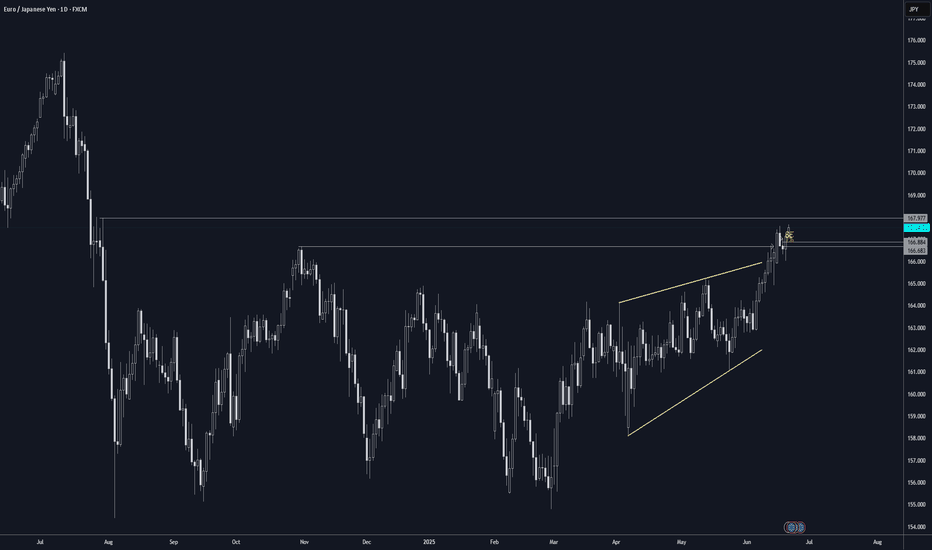

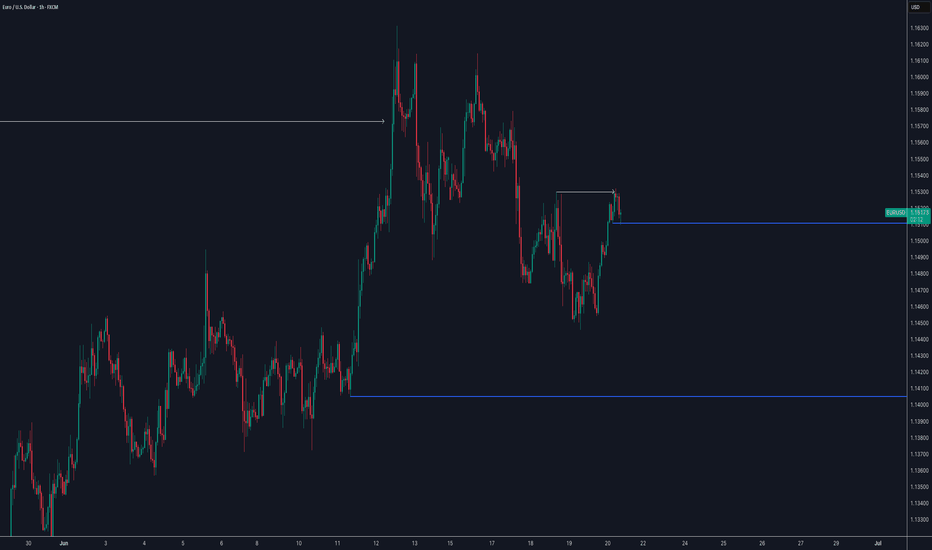

EURUSD - BreakdownApologies video is a bit rushed.

Wanted to get it done before the weekend arrived.

There's so much more to this video and entry reason that I have left out unintentionally like the fact we swept the Asia lows before creating a BoS. There are also a few other things like I have left out but without looking at the chart right now I cannot remember off the top of my head.

I will post the idea of this trade below so you can see that I was taking it before it played out.

Hope you all have a great weekend and a better trading week than you had this week.

Enjoy

P.S if you have any questions please do message

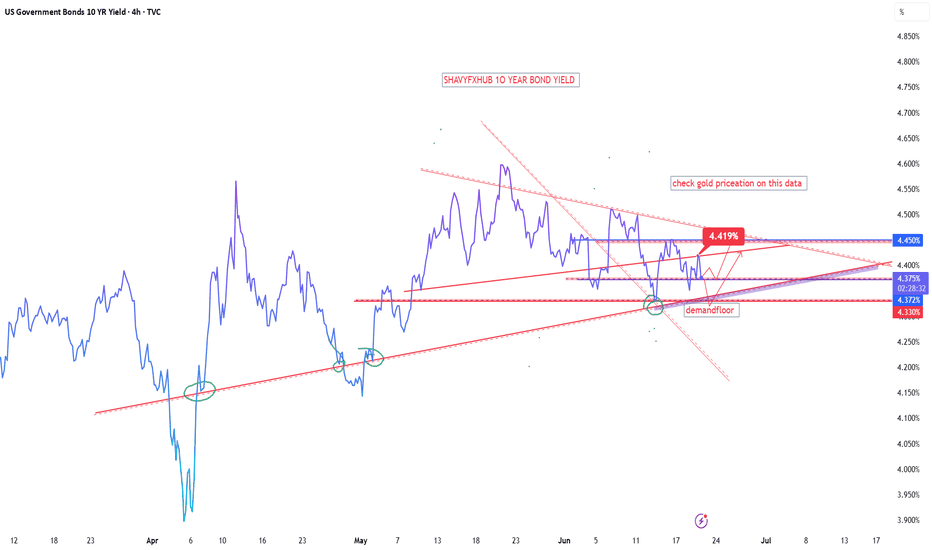

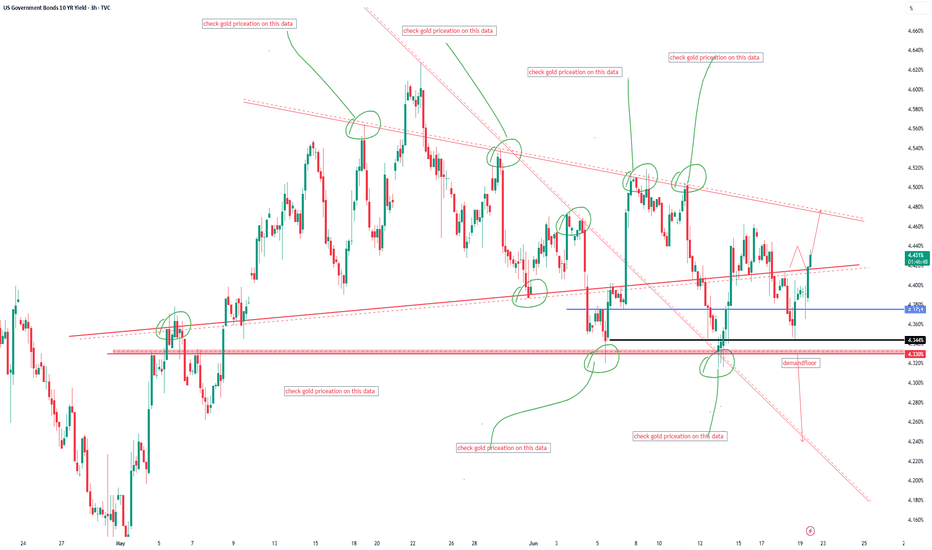

US10Y UNITED STATES GOVERNMENT 10 YEAR BOND YIELD.the US 10-Year Treasury Yield (US10Y) stands at 4.39%-4.5%,The 10-year yield is a key benchmark for long-term interest rates in the United States and is closely watched by investors as an indicator of market sentiment regarding economic growth, inflation, and Federal Reserve policy.

The yield has been rising recently, reflecting investor concerns about US fiscal policy, inflation, and the outlook for Federal Reserve rate cuts.

Federal Reserve Interest Rate Decision (June 2025)

The Federal Reserve held its key interest rate steady at 4.25%–4.50% at its June 2025 meeting.

This marks the fourth consecutive meeting with no change in rates, as the Fed continues its cautious, data-dependent approach amid persistent inflation and moderate economic growth.

The Fed’s latest “dot plot” and projections indicate that two 25-basis-point rate cuts are still possible by the end of 2025, but expectations for cuts in 2026 and beyond have been reduced.

Key Drivers and Outlook

Yield Movements: The 10-year yield has climbed amid concerns about US fiscal deficits, credit rating downgrades, and the impact of tariffs and trade policy on inflation.

Fed’s Tone: The FOMC statement and projections reflect ongoing stagflationary pressures—slower growth, persistent inflation, and a slightly rising unemployment rate.

Market Expectations: Markets are pricing in two rate cuts by year-end, most likely in September and December, but nearly half of Fed officials see little or no room for cuts in 2025 if inflation remains sticky.

Conclusion

The US 10-year Treasury yield remains elevated as markets weigh fiscal risks, inflation, and the Fed’s cautious stance.

The Fed is holding rates steady but signaling that two rate cuts remain possible in 2025, with future moves highly dependent on incoming data, especially inflation and labor market trends.

Investors should expect continued yield volatility as economic and policy uncertainties persist.

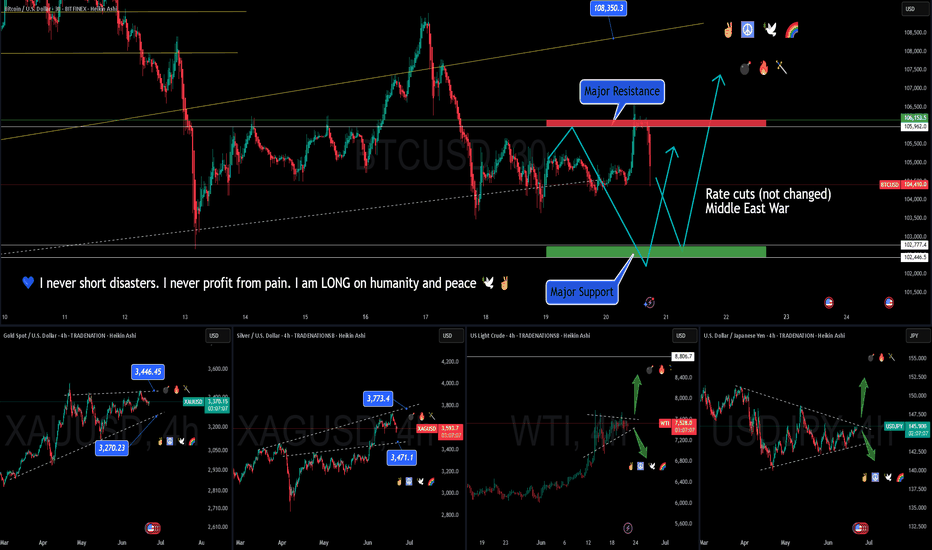

Middle East Tension & Markets: My Honest Stance🌍🕊️✌️ Middle East Tension & Markets: My Honest Stance 💣 🔥 🗡️

Hi everyone,

It’s Friday, June 20th — and we face a fragile moment: the uncertainty of possible US military action against Iran. 📉📰✈️

On my charts:

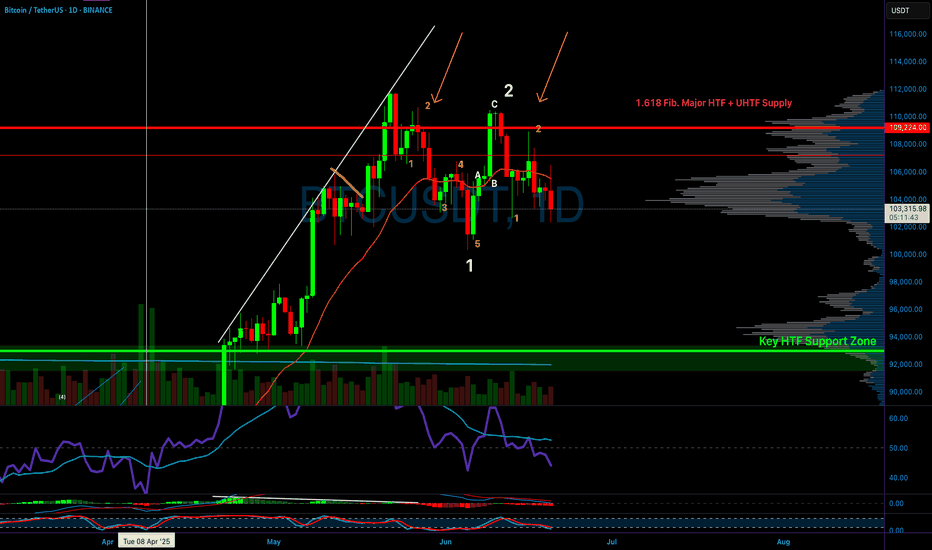

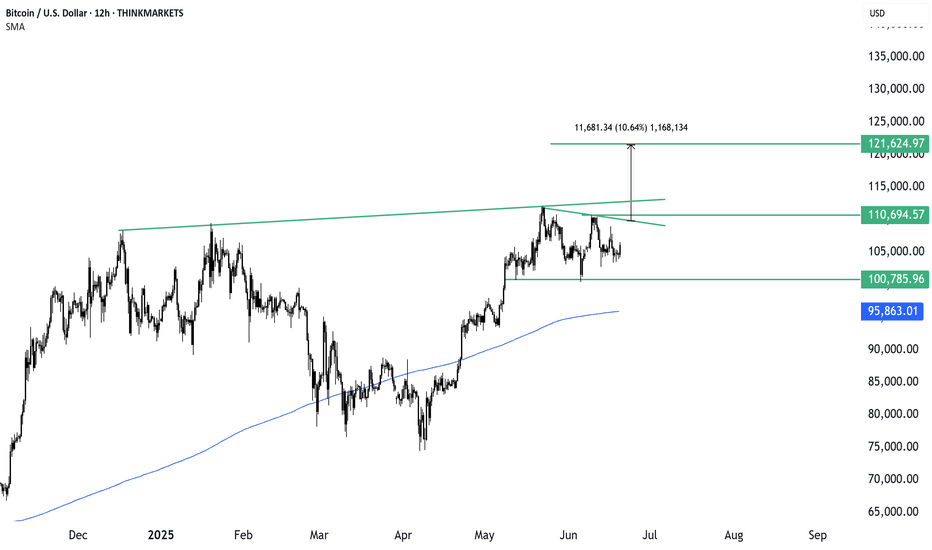

Bitcoin (BTC) reached key resistance and now ranges sideways as we await clarity.

Gold (XAUUSD) remains the classic safe haven — it holds an ascending structure, but profit-taking could trigger dips if markets crash.

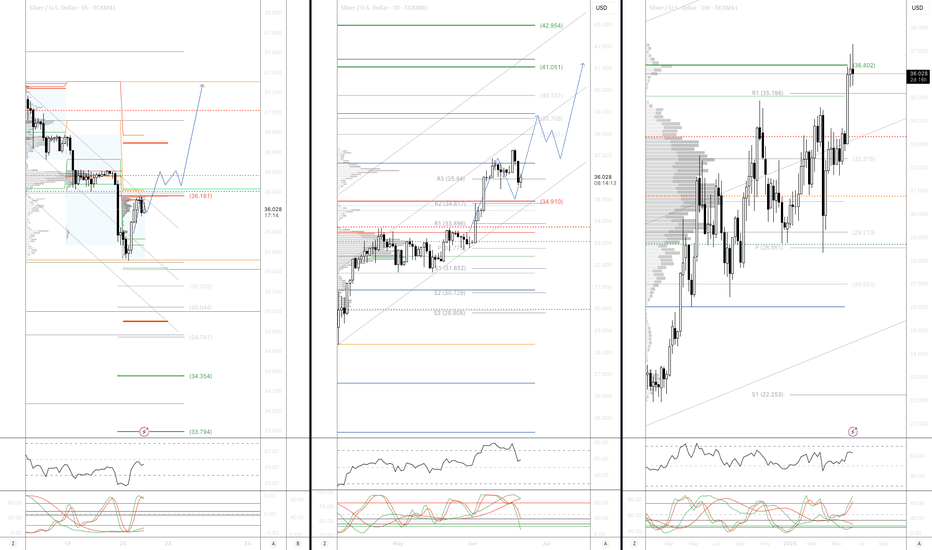

Silver (XAGUSD) is similar, yet needs broader industrial strength to outperform gold.

Crude Oil (WTI) could spike dramatically if bombs fall — but I choose not to profit from pain.

USDJPY & USD pairs reflect global trust in the dollar and US stability — I’ll cover this more next week.

My personal stance is simple:

💙 I never short disasters. I never profit from human suffering. I am LONG on humanity and peace. 🕊️✌️🌈

👉 I expect potential market gaps between now and Monday:

✅ Bad news (war) → gold, silver, oil likely pump

✅ Good news (diplomacy) → risk assets rebound, oil stabilizes

I am positioned carefully with small risk and clear stops. My goal: protect my capital, trade my plan, but never bet on pain. If I lose because peace prevails — I win as a human.

Stay safe, trade wisely, and never forget: sometimes the best trade is no trade at all.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

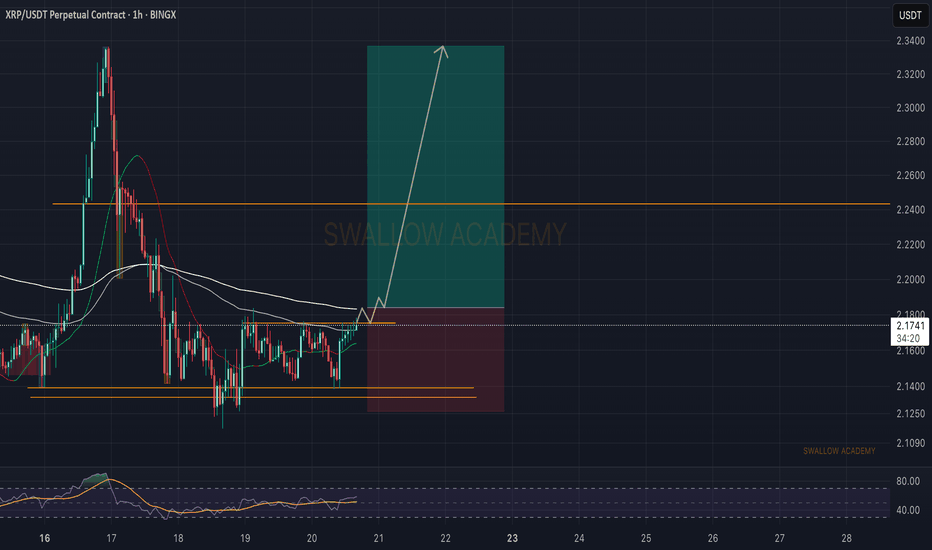

Ripple (XRP): Seeing Smaller Bullish Movement To AccumilateRipple coin has extended itself heavily since november but what we noticed is how close the 200EMA line on the daily timeframe has come to the market price, which is our main point of interest as of now.

More in-depth info is in the video—enjoy!

Swallow Academy

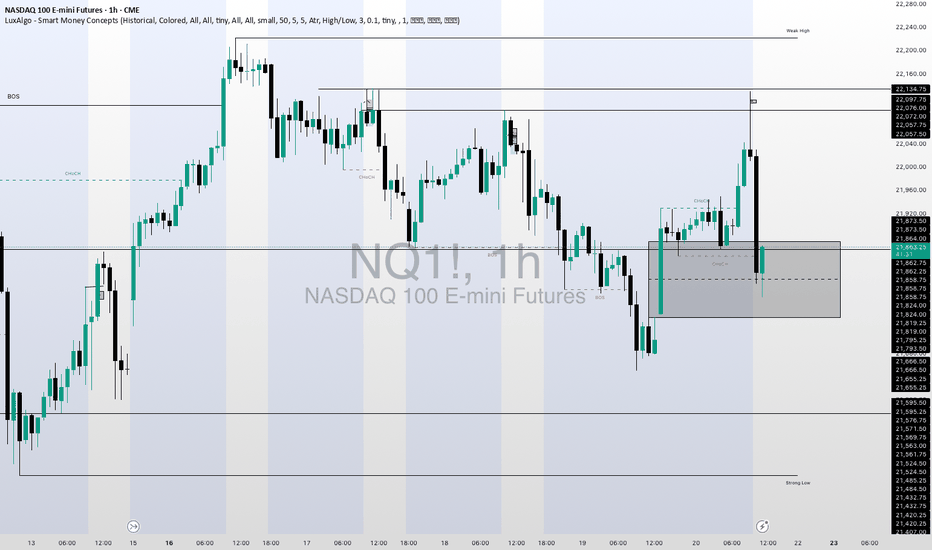

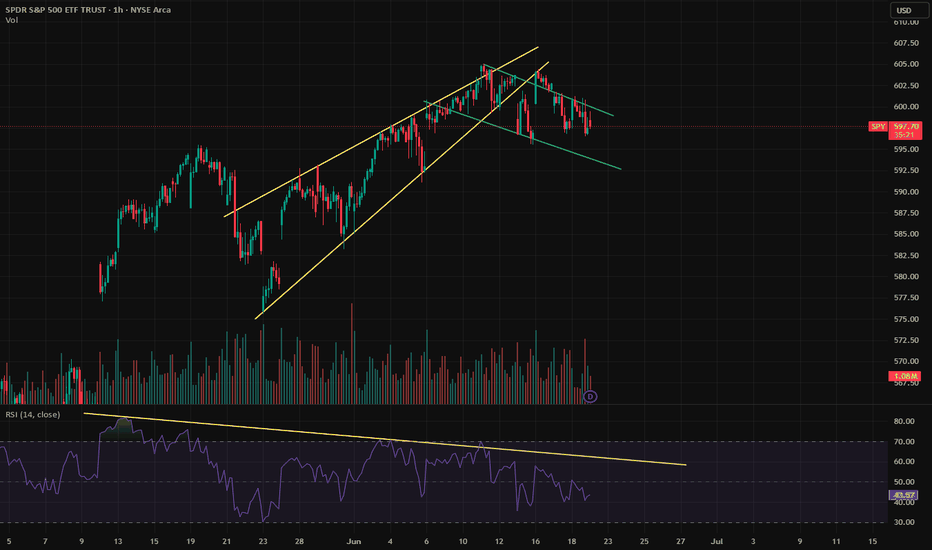

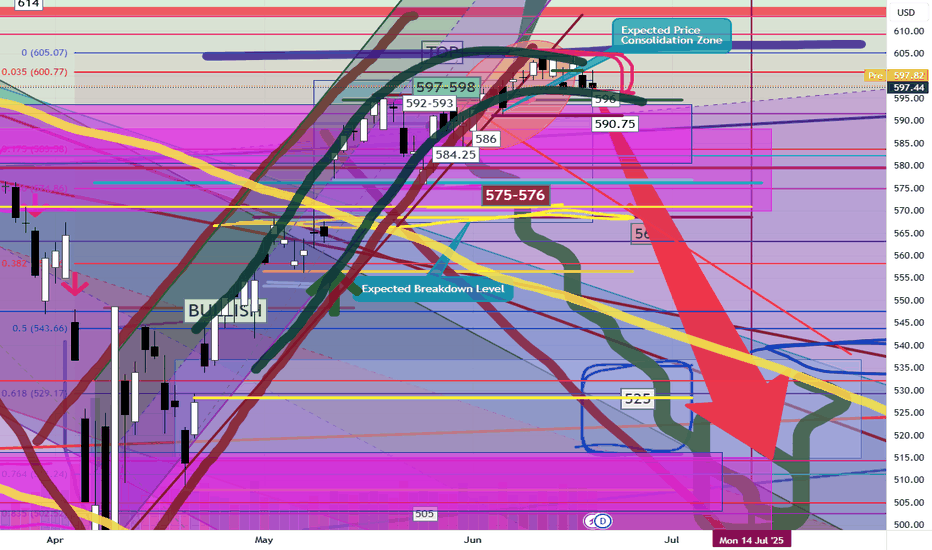

SPY/QQQ Plan Your Trade For 6-20 : Pause Bar PatternToday's Pause Bar pattern suggests the SPY/QQQ will slide into a sideways type of PAUSE in price action today. I'm not expecting much to happen and if we do see any breakaway or breakdown trending it will likely be related to news.

While we have options expiration today and a host of other things that could drive the markets, I believe the markets are struggling to find direction right now. Thus, a pause in trading would be somewhat normal after a holiday-shortened trading week.

Gold and Silver are struggling after a brief rally last week. I believe this is fear related to the Israel/Iran conflict. Metals should continue to move higher.

BTCUSD is slightly higher (forgot to cover BTCUSD in the video), but not moving into a breakaway phase.

Overall, everything is very flat in early trading today. It may stay that way with my PAUSE BAR pattern.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

10 year united states government bond yieldthe US 10-Year Treasury Yield (US10Y) stands at 4.435% newyork session,The 10-year yield is a key benchmark for long-term interest rates in the United States and is closely watched by investors as an indicator of market sentiment regarding economic growth, inflation, and Federal Reserve policy.

The yield has been rising recently, reflecting investor concerns about US fiscal policy, inflation, and the outlook for Federal Reserve rate cuts.

Federal Reserve Interest Rate Decision (June 2025)

The Federal Reserve held its key interest rate steady at 4.25%–4.50% at its June 2025 meeting.

This marks the fourth consecutive meeting with no change in rates, as the Fed continues its cautious, data-dependent approach amid persistent inflation and moderate economic growth.

The Fed’s latest “dot plot” and projections indicate that two 25-basis-point rate cuts are still possible by the end of 2025, but expectations for cuts in 2026 and beyond have been reduced.

Key Drivers and Outlook

Yield Movements: The 10-year yield has climbed amid concerns about US fiscal deficits, credit rating downgrades, and the impact of tariffs and trade policy on inflation.

Fed’s Tone: The FOMC statement and projections reflect ongoing stagflationary pressures—slower growth, persistent inflation, and a slightly rising unemployment rate.

Market Expectations: Markets are pricing in two rate cuts by year-end, most likely in September and December, but nearly half of Fed officials see little or no room for cuts in 2025 if inflation remains sticky.

Conclusion

The US 10-year Treasury yield remains elevated as markets weigh fiscal risks, inflation, and the Fed’s cautious stance.

The Fed is holding rates steady but signaling that two rate cuts remain possible in 2025, with future moves highly dependent on incoming data, especially inflation and labor market trends.

Investors should expect continued yield volatility as economic and policy uncertainties persist.

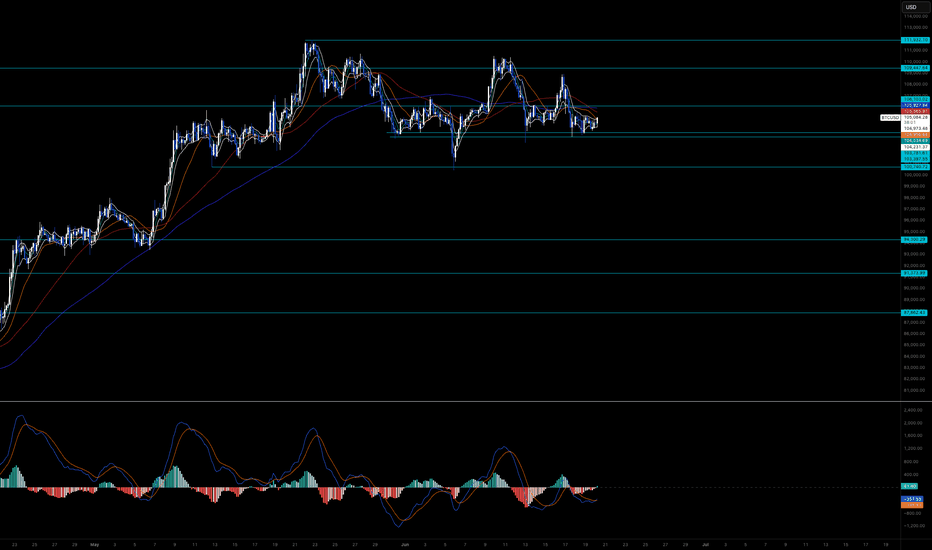

BTC levels to watch for a breakoutMarkets are quiet, and Bitcoin is coiling. A potential breakout looms as we await the President’s Working Group crypto update by July 23. Will positive news trigger a rally to $121,000? Watch for key levels and triangle patterns.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

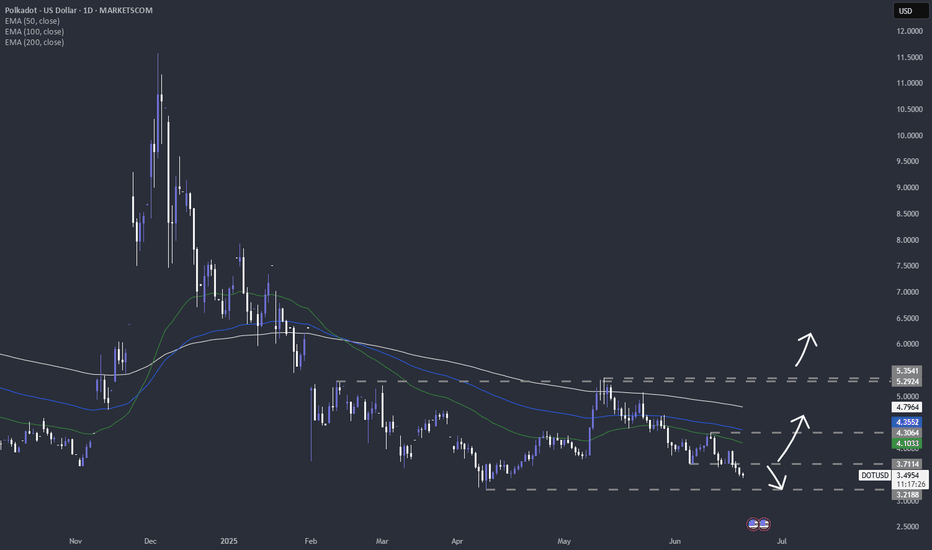

Polkadot (DOTUSD) is getting closer to a scary levelPolkadot ( MARKETSCOM:DOTUSD ) is coming closer to the current lowest point of this year. If it surpasses that area, then this would place the crypto in the area, last seen five years ago, bringing it closer to inception price.

Let's dig in...

CRYPTO:DOTUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

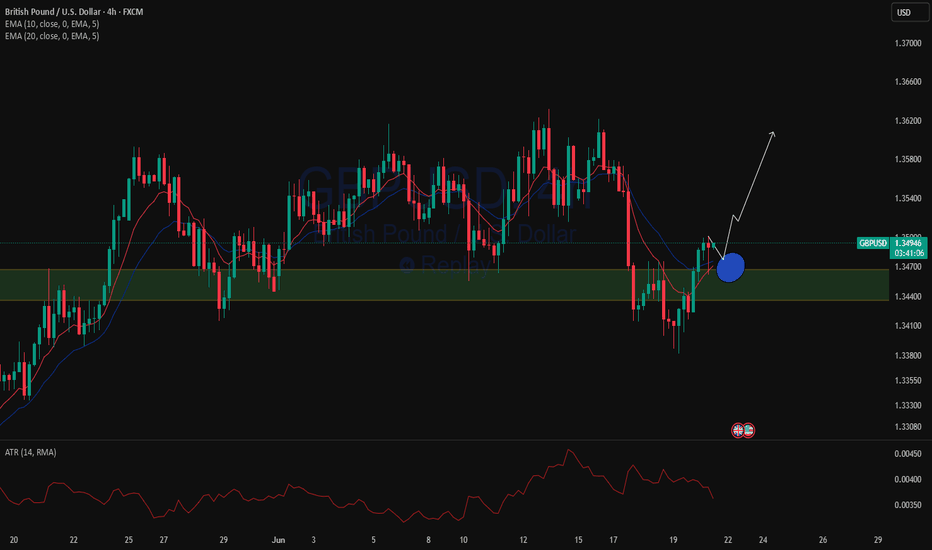

AUDUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

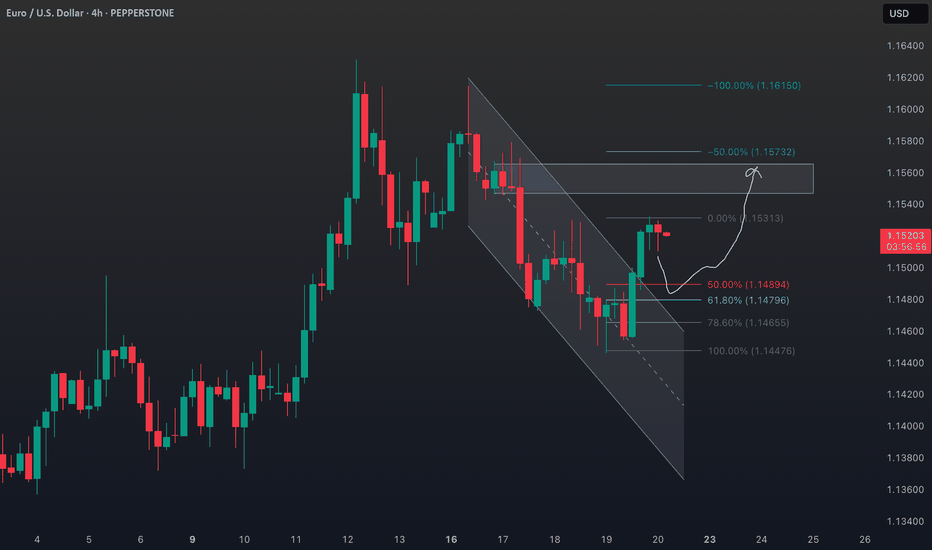

EURUSD Breaks Structure: Bullish Continuation Opportunity💶 EUR/USD Analysis – Bullish Momentum Builds 📈

Taking a look at the EUR/USD on the daily chart, it’s clear the pair is currently in a strong bullish trend 🚀. Momentum has been building consistently, reflecting underlying euro strength and continued USD weakness.

🕓 On the 4H timeframe, we’ve now seen a clear shift in market structure to the upside, confirming bullish intent. Look for a continuation entry after a retracement back into equilibrium — ideally around the 50% level of the current price swing 🔄📐.

🎯 Trade Plan Idea:

Wait for price to pull back into equilibrium 🌀

Entry: Long from the discounted zone 🟩

Stop loss: Just below the recent swing low 🔻

Target: Previous high as a logical take-profit zone 🎯📊

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be considered financial advice. Always do your own research and consult with a qualified financial advisor before making any trading decisions. 📚💼

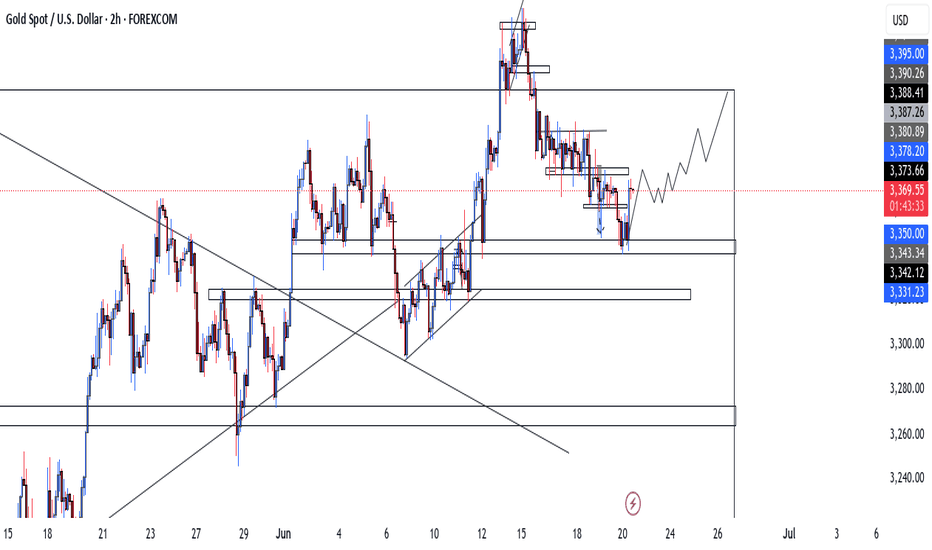

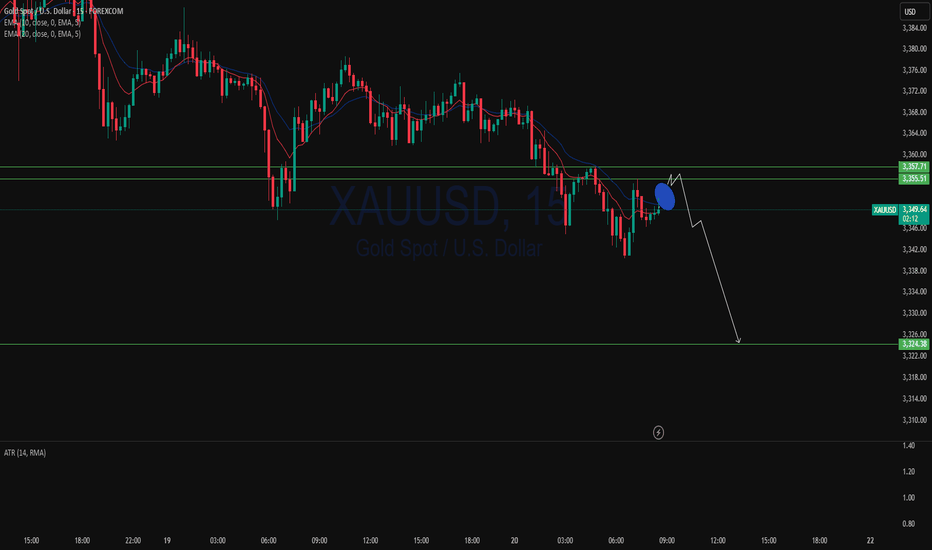

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Market Shockwaves: DXY Surges, Gold Slips & Bitcoin Tests $100K This week delivered powerful market moves as the U.S. Dollar roared higher, gold struggled under macro pressure, and Bitcoin teetered on the $100K edge. In this must-watch market recap, we break down the key economic events, geopolitical tensions, and technical signals that drove DXY, XAUUSD, and BTCUSD — and more importantly, what it all means for the week ahead.

🔍 In this video, we cover:

✅ Why the dollar is rebounding and what’s fueling its strength

✅ The real reason gold is under pressure despite global risk

✅ Bitcoin’s next move: breakdown or bounce?

✅ Key levels and events to watch as we close out this week

✅ What traders and investors should prepare for next week

Whether you're a day trader, swing trader, or just watching the macro landscape — this recap gives you the edge.

👉 Don’t forget to like, comment, and subscribe for weekly insights!

#DXY #Gold #Bitcoin #MarketRecap #TradingInsights #MacroTrends #TechnicalAnalysis