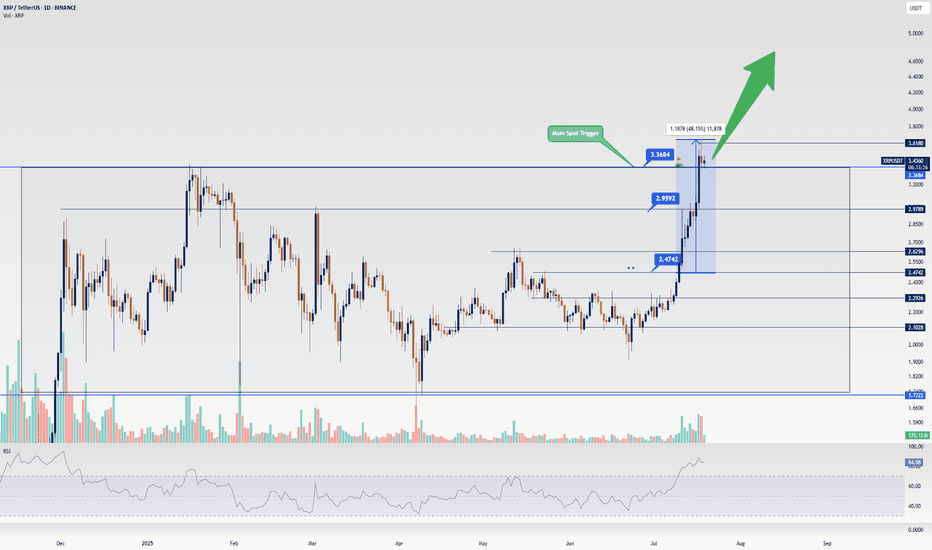

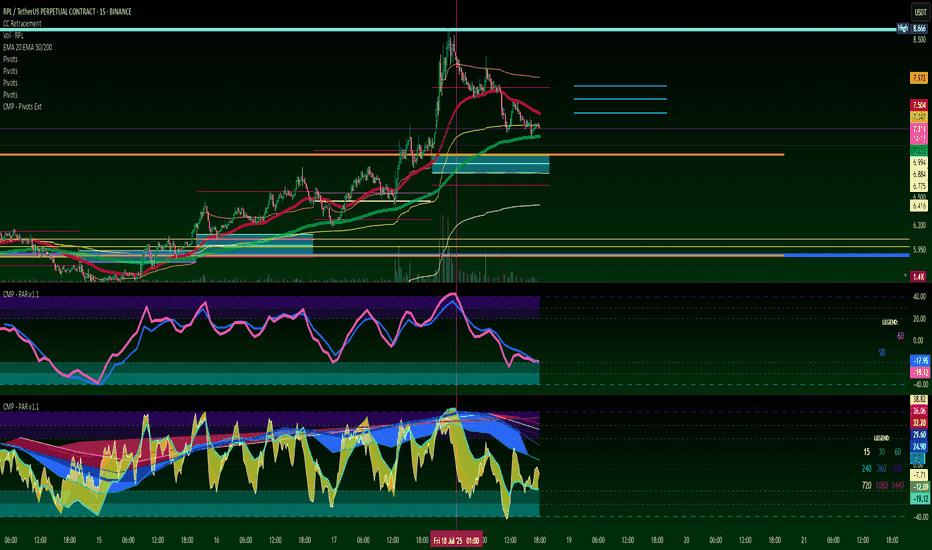

Ripple Update: Is XRP Ready for Another 500% Growth?Hey friends, it’s Skeptic 🩵 . In this video, I’m giving an update on Ripple’s conditions , reviewing past triggers, and what to do with your long positions in futures if you’re still holding. For spot, what’s the move? I dove into XRP/BTC analysis and, at the end, broke down BTC.D , which just had a major event you need to pay close attention to. Don’t forget money management, and stay clear of FOMO. Drop your thoughts on XRP in the comments so we can chat about it!

Community ideas

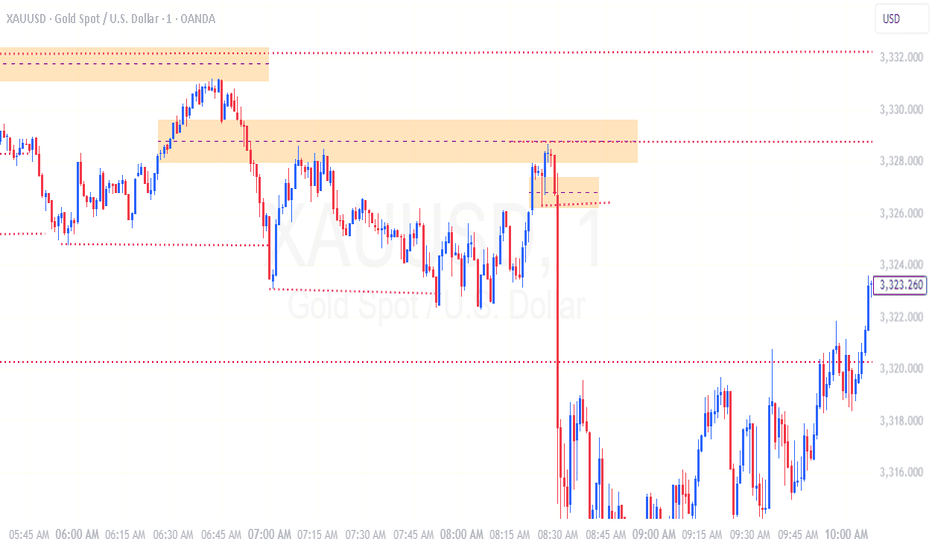

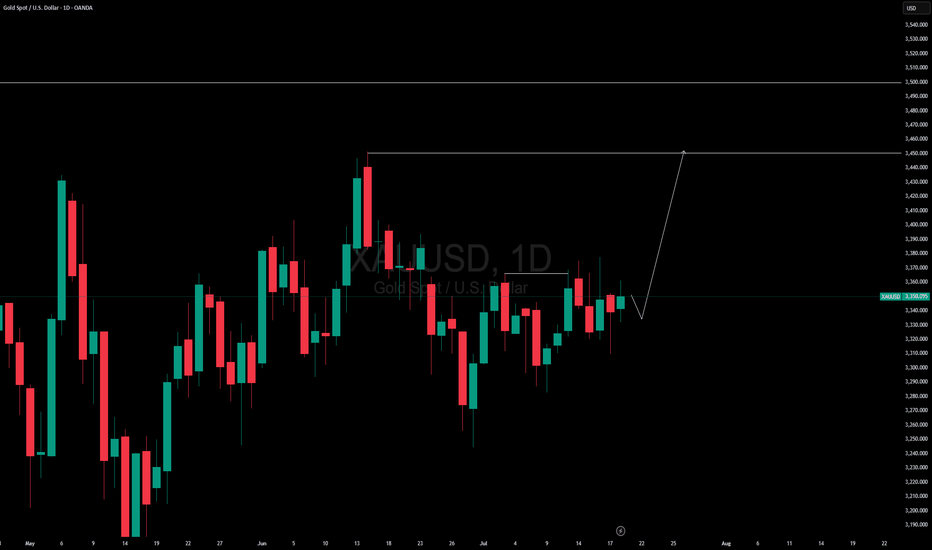

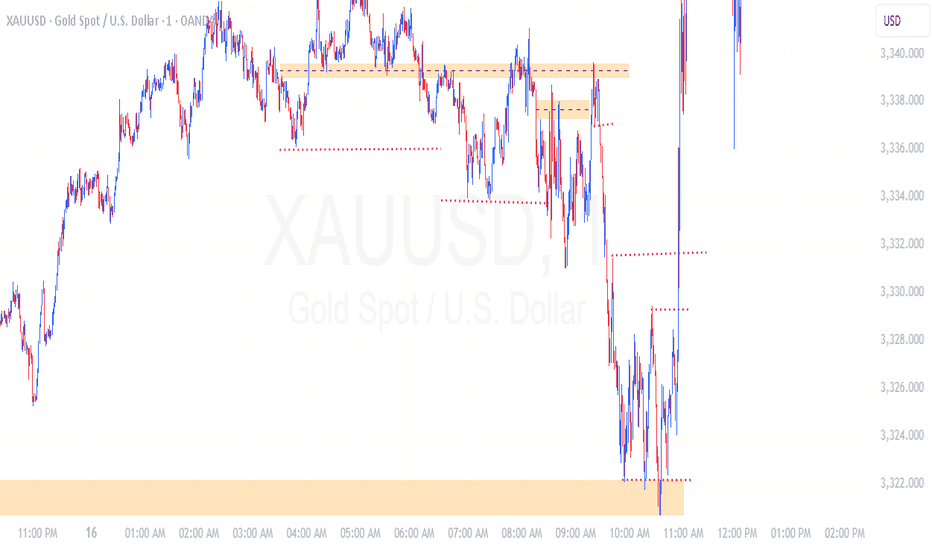

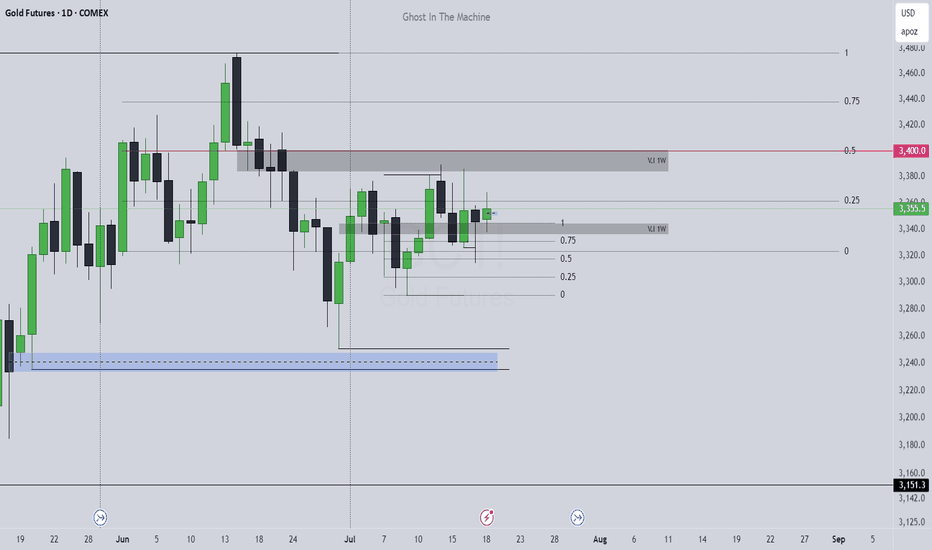

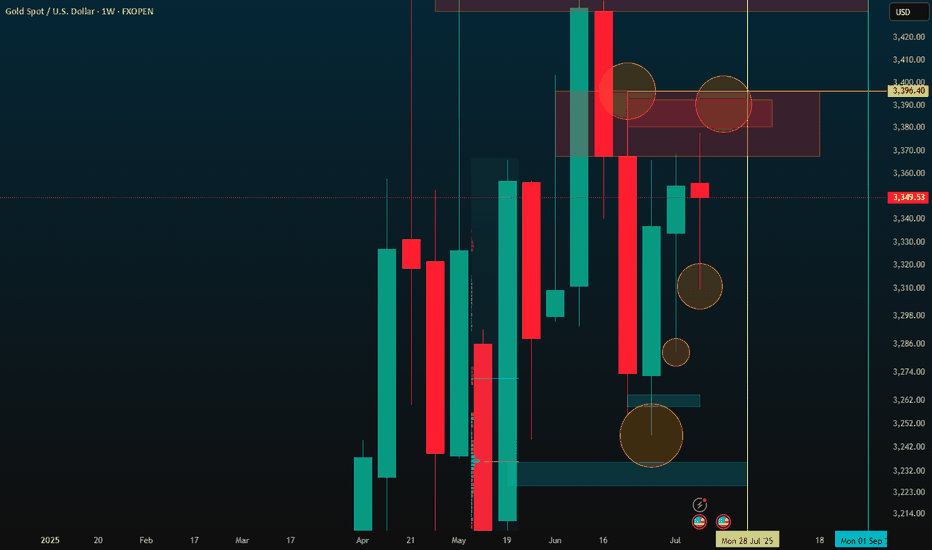

XAUUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

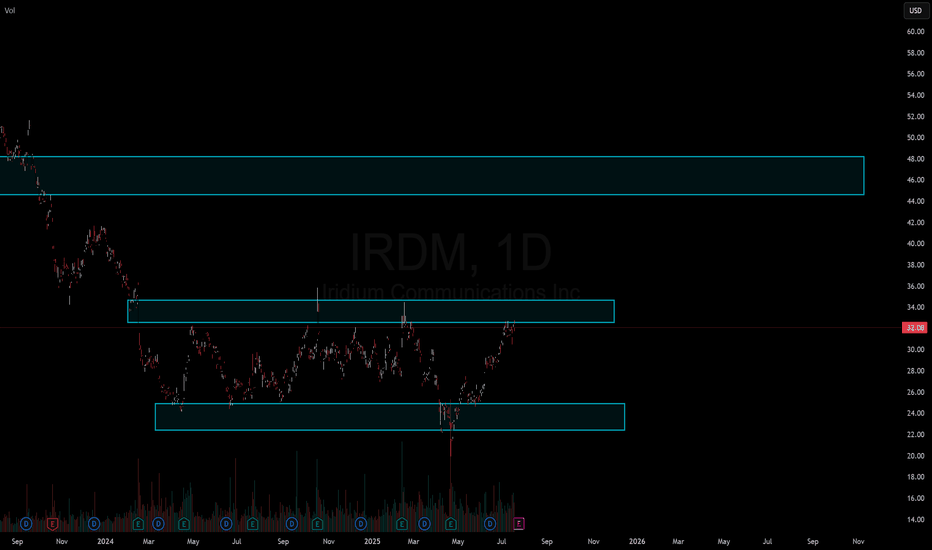

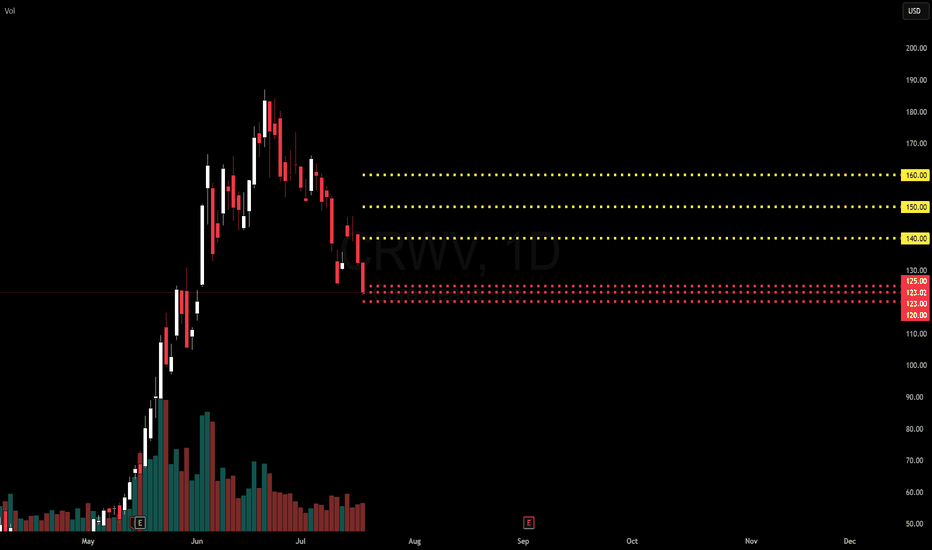

IRDM: Make or Break It Hey everyone,

This is more of a fundamental idea on one of my favourite companies, IRDM, though there is math and analysis involved.

Here are key points that I didn't want to elaborate on in the idea, but just for background info.

Summary of Earnings Transcript from Q1:

Iridium Communications reported solid performance with 6% growth in operational EBITDA and continued service revenue growth across key areas, including IoT, PNT, and engineering. CEO Matt Desch addressed uncertainties stemming from new U.S. tariffs, which could add up to $7 million in annual costs if fully implemented, though Iridium has mitigation strategies in place. Despite global trade volatility and increased competition from entrants like Starlink, Iridium remains confident in its differentiated offerings—particularly its L-band network, global coverage, and mission-critical capabilities. The company highlighted momentum in its next-gen IoT and Direct-to-Device (NTN Direct) services, GPS-alternative PNT solutions (boosted by its Satelles acquisition), and government partnerships. CFO Vince O’Neill confirmed full-year guidance for 5–7% service revenue growth and $490–500 million in operational EBITDA, citing robust free cash flow generation, healthy liquidity, and strong shareholder returns via dividends and buybacks. Management reiterated long-term confidence in Iridium’s growth strategy through 2030, supported by its technological edge and diverse partner ecosystem.

History of Irdium

1987: The concept for Iridium was born at Motorola’s Strategic Electronics Division in Arizona.

1990: Motorola publicly announced the Iridium project at simultaneous press conferences in New York, Beijing, London, and Melbourne

1991: Iridium Inc. was incorporated to develop and deploy the satellite network.

1997: The first Iridium satellites were launched from Vandenberg Air Force Base, beginning the build-out of the constellation.

November 1, 1998: Iridium officially launched its commercial satellite communications service. The first call was made by U.S. Vice President Al Gore to Gilbert Grosvenor, great-grandson of Alexander Graham Bell.

Iridium has had a slew of hardship, having filed for bankruptcy in 1999 and being revised in 2001.

IRDM's major competitors are Inmarsat, Globalstar ( BOATS:GSAT ) to a lesser extend as their network is not as broad, Telesat and Visat.

Starlink is not a direct competitor for Iridium as they server different purposes, but Iridium already faces strong competition with the above mentioned companies, in addition to the evolving companies such as NASDAQ:ASTS and NASDAQ:RKLB which have the ability to completely derail Irdium if they advance faster than Iridium can keep up.

These are my thoughts, hope you enjoyed!

Safe trades!

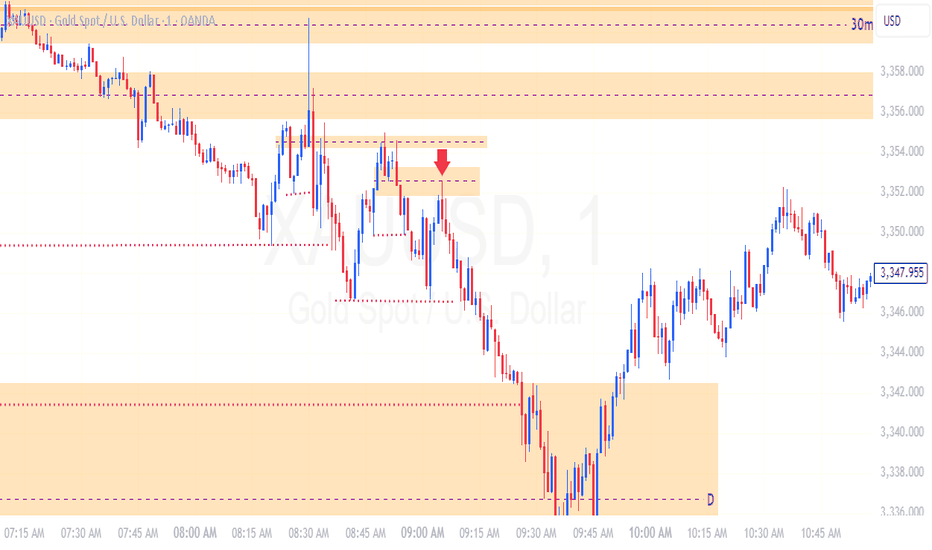

Trading Game of the Day 16-JULY-2025Trading Plan :-

1-PDA targen from IRL to the ERL

2-iFVG and FVG together with MSS and CISD

3-release PPI at 08:30 am NYT

4-double bottom and LOD is the target like a magnet for the price

these are the confirmation tools for the direction of the price for the target

Thank You

Trading Game of the Day 15-JULY-2025Trading Plan :-

1-the price from one PDA to another PDA

PDA is either swing point ,weekly high and low ,daily high and low and FVG

DOUBLE BOTTOM /TOP and TRIPLE BOTTOM /TOP are a very beautiful areas to be target by the price specially when there is FVG beyond it

these are areas of accumulation of Liquidity

2-release of CPI at 08:30

3-iFVG and FVG together with MSS and CISD

All these make my trading profitable

Thank You

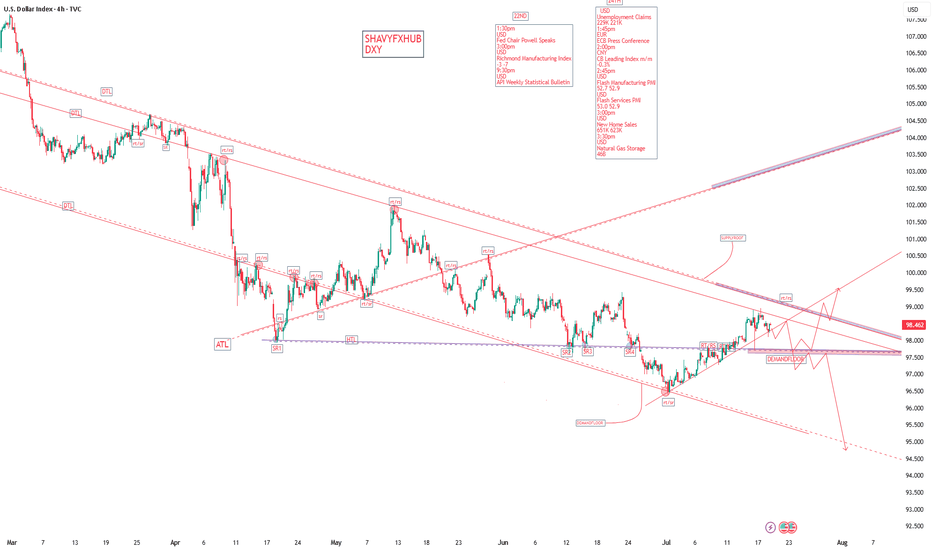

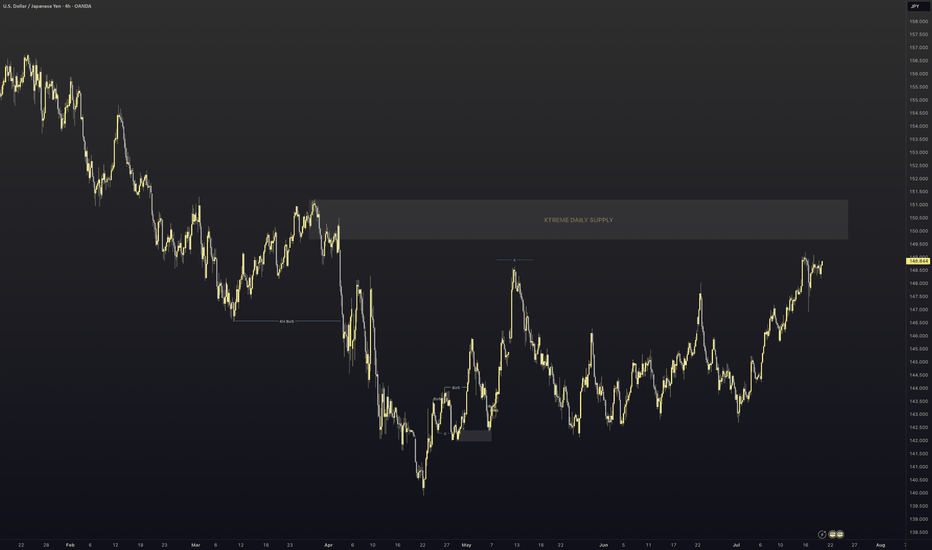

DXYDXY refers to the U.S dollar index ,an index that measures the value of united state dollar relative to a basket of six major foreign currencies ,it was originally developed by FED'S

THE SIX MEJOR CURRENCIES ARE ;

.euro,japaneses yen, pounds sterling, Canadian dollar, Swedish krona,swiss franc.

the index is used by investors ,traders and economist to gauge the overall strength of the U.S dollar in a global currency markets. Its rise and fall will influence trade ,investment and monetary policy decision in fx window.

on 4hr we are rejected and i will watch market open and close on Monday for trade directional bias for the following pairs (AUDUSD,USDCAD,USDZAR,GBPUSD,EURUSD,USDJPY,XAUUSD XAGUSD,XCUUSD,BITCOIN )

NOTE;TRADING IS 100% PROBABILITY,RISK MANAGEMENT IS KEY AND GET ACCOUNTABLITY PARTENER WHO WILL BE CHECKING YOUR WORK..

#DXY #DOLLAR

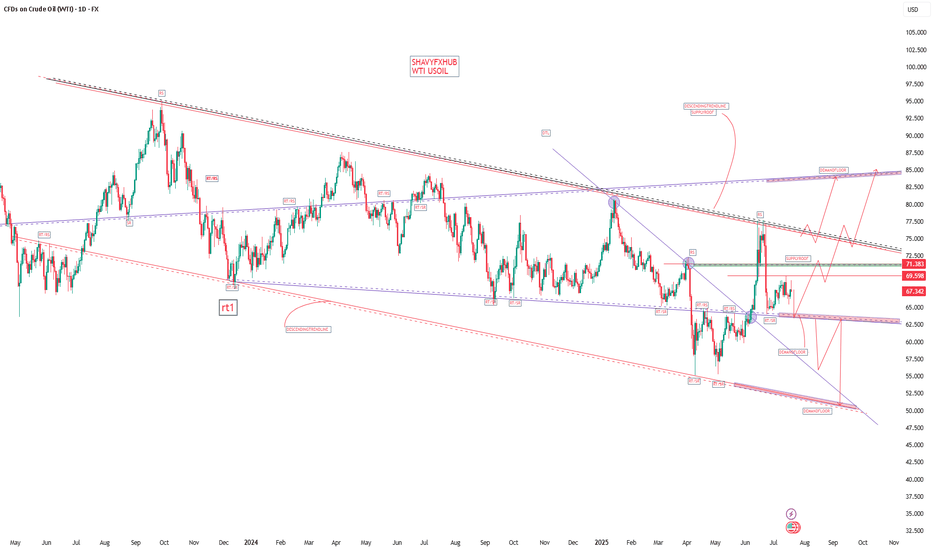

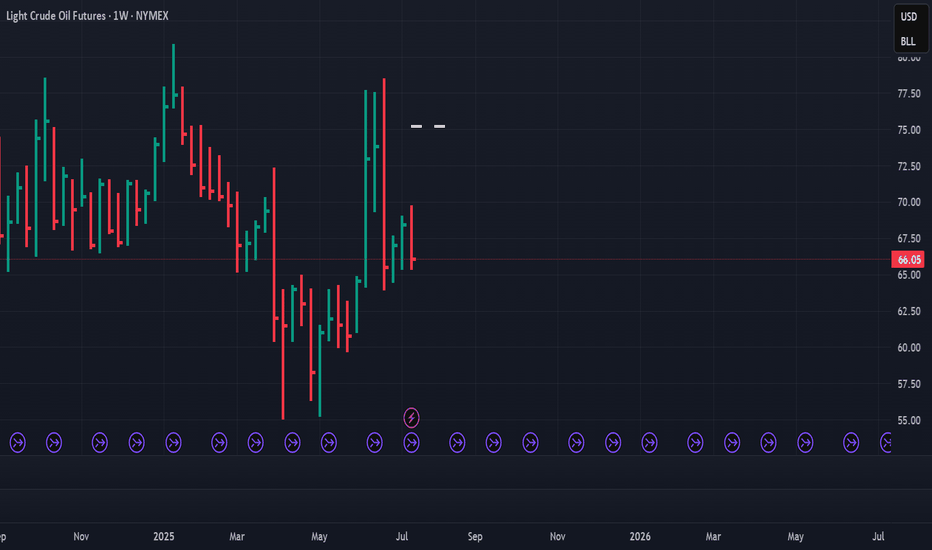

WTI USOIL As of July 19, 2025, the WTI crude oil price is hovering around $67.342 to $68.83 per barrel after attempting 77.52$ per barrel on Israel Iran conflict in the middle east. As a trader Make out time to look into OPEC WORLD OIL OUTLOOK(WOO) REPORT,SPR REPORT , this woo report provide comprehensive industry forecast and strategic petroleum reserve gives insight into united state energy status.

OPEC meetings are usually held in Vienna and involves discussions and agreement on oil production quotas affecting the global crude oil supply and prices.

oil sharply rose during Israel and Iran geopolitical tension and on the supply roof rejected AT 77.52$ PER BARREL ..

Supply remains cautiously controlled because price is influenced by demand and supply system , but global economic uncertainties and trade tensions, especially involving tariffs and sanctions, continue to influence oil demand expectations.

the US Strategic petroleum reserve (SPR) is the united states emergency crude oil stockpile managed by department of energy ,it act as a buffer to protect against significant supply disruption of oil market, the SPR holds hundreds of millions of barrels of crude oil stored in the underground salt caverns along the gulf coast.it can be tapped to stabilize the market during supply crises or emergencies .

the U.S government occasionally release oil from the SPR to ease supply shortage or control fuel prices coordinated with other countries through the international energy agency if need be.the status and release are regularly monitored as they affect global oil prices and energy security

Am holding WTI OIL low buy and will continue until the break of demand floor and might add more buy if the sentiment holds buy idea.

Trading OIL AND GAS is 100% probability , No one can tell the next crisis and global energy supply disruption.

Manage your risk.

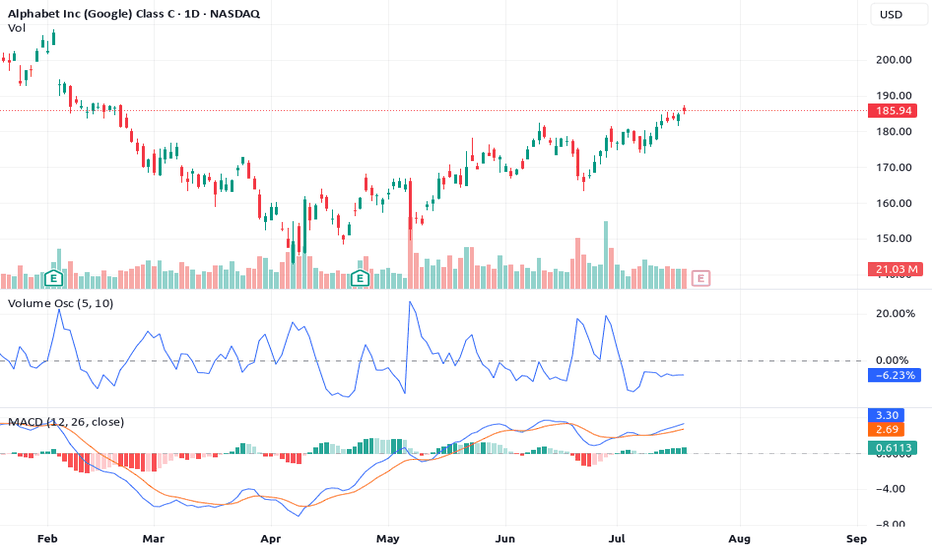

"These 3 power signals boost the 3-step rocket booster strategy"Am lubosi forex and i would like to welcome you.This is where i share with you technical analysis strategies.

I started trading in 2017 and learning about it has not been easy.My hope for you is that this channel will shape your trading journey and help you

Find a path to making money on your own terms.

In this video am showing you the rocket booster strategy

using 3 indicators and catalysts as follows:

1-Volume Oscillator

2-MACD Indicator

3-Earnings Report Catalyst

These 3 power signals boost

the 3-step rocket booster strategy

Watch this video

to learn more

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money

also learn risk management and profit taking strategies.

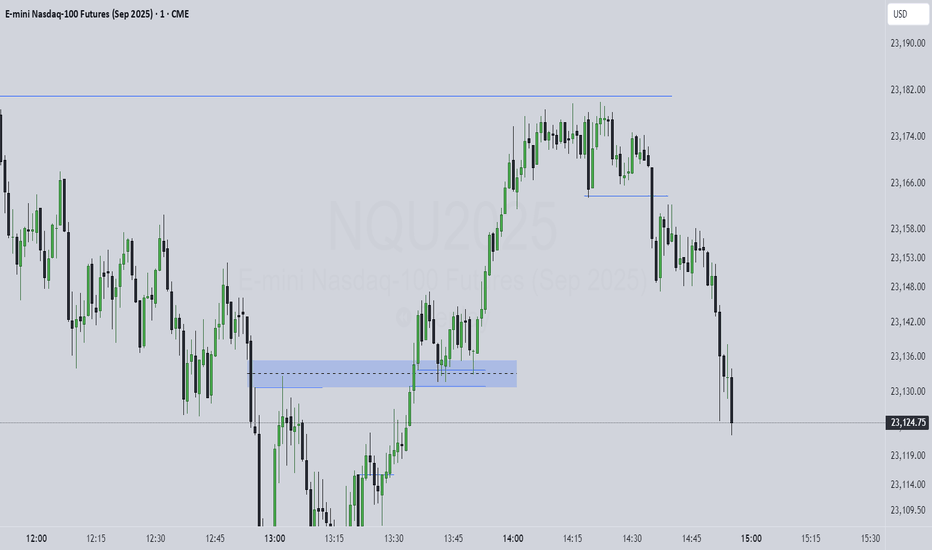

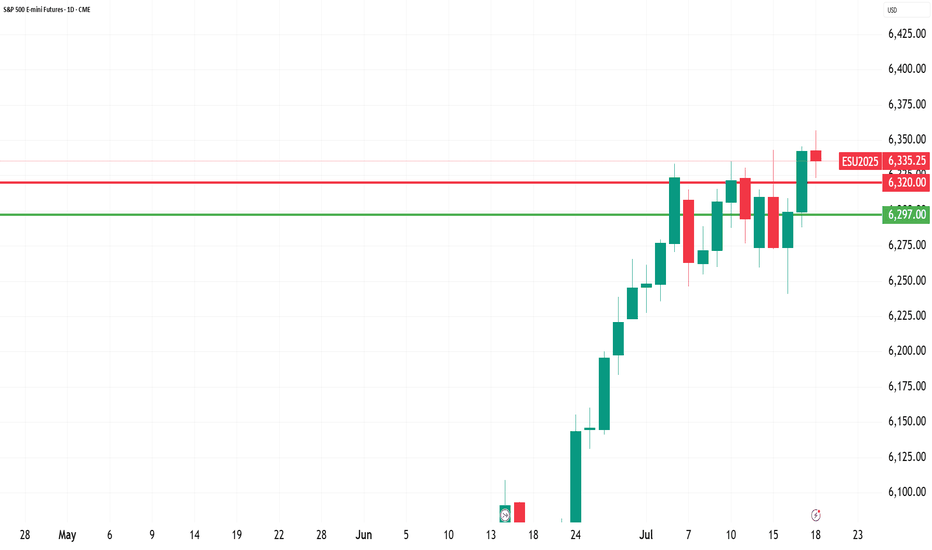

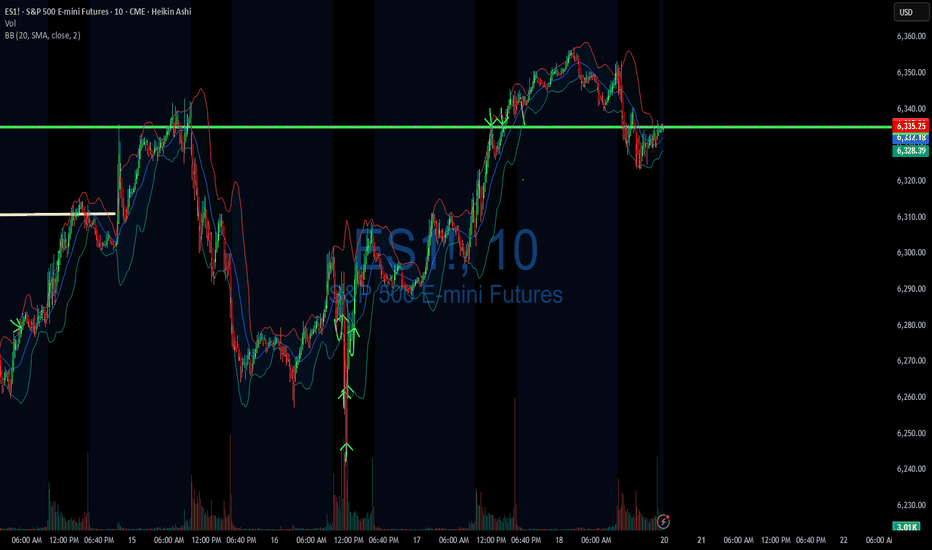

DIYWallSt Trade Journal:$238 Lessons From Monthly Expiration07/18/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +238.75

Sleep: 5. hours

Overall health: Was working late last night and didn't get much sleep.

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bullish on VX Algo X3!

— 10:30 AM Market Structure flipped bearish on VX Algo X3!

— 11:10 AM VXAlgo ES X1 Buy signal (didn't work that well)

— 12:10 PM VXAlgo NQ X1DD Sell Signal

— 12:19 PM Market Structure flipped bullish on VX Algo X3!

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was monthly expiration for options and we got a lot of X7 Sell signals but structure was bullish so I tried to take a long at MOB and got burned. Flipped bearish and started shorting the rest of the day and ended up making money back.

News

*US STOCKS MOVE LOWER AFTER REPORT SAYS TRUMP PUSHES FOR 15-20% MINIMUM TARIFF ON ALL EU GOODS

What are the critical support levels to watch?

--> Above 6335= Bullish, Under 6315= Bearish

Video Recaps -->https://tradingview.sweetlogin.com/u/WallSt007/#published-charts

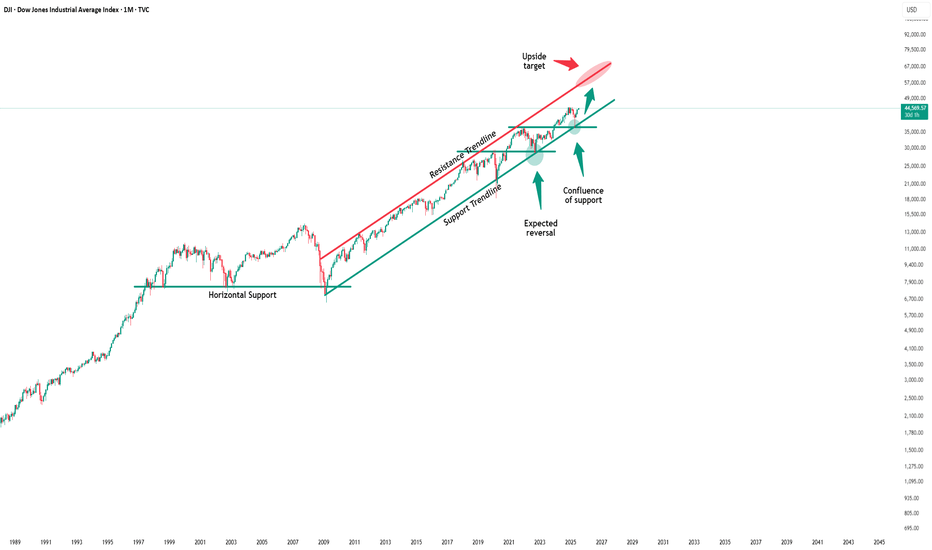

Dow Jones -> A breakout rally of +40%!🐂Dow Jones ( TVC:DJI ) will create new highs:

🔎Analysis summary:

Since the April lows, the Dow Jones already rallied about +25%. This was simply the expected rejection away from a strong confluence of support. Now, the Dow Jones is sitting at the previous all time highs and about to break out, leading to a massive rally.

📝Levels to watch:

$45.000, $60.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader